0.75% Rate Increase by the Fed During the Bear Stock Market

Canada, take notes

US Federal Reserve (Fed) increased its key rate by 0.75% today (link).

Not only that’s the biggest hike since 1994, but it’s also happening at a time when S&P is in a bear market territory.

Those two events together would be totally unimaginable 3+years ago so it’s important to pay attention because what we are seeing today is clarifying a lot of misunderstandings about the Fed.

Inflation targeting

The inflation-targeting mandate is crucial. During today’s press conference, Fed mentioned countless times that it’s absolutely crucial for them to get inflation back to 2%. Yet, some people still believe they have more important tasks like saving stock or housing markets so they are going to pivot, abandoning the 2% inflation goal. That is a speculation and it’s not supported by Fed’s messaging. It’s important to clarify, that Fed’s decisions are based on long-term inflation expectations and not short-term ones. I created a post clarifying that.

Also, it’s important to mention that Fed has a dual mandate which is focused on both inflation and labour market, while the Bank of Canada has inflation as a primary mandate and labour market as a secondary one.

Only when long-term inflation expectations decline or unemployment increases we should expect Fed to pivot.

Inflation targeting is a simple concept that explains everything. It explains why the Fed was printing “recklessly” between 2008 and 2021 and why they are tightening now.

Independence

Excessive Fed printing in the last decade was a response to deflationary forces while many attributed it to politicizing Fed, preventing all hardship for households, and preserving valuations of asset classes. In reality, for the most part of the last decade inflation was below 2%, and that’s despite all the easing.

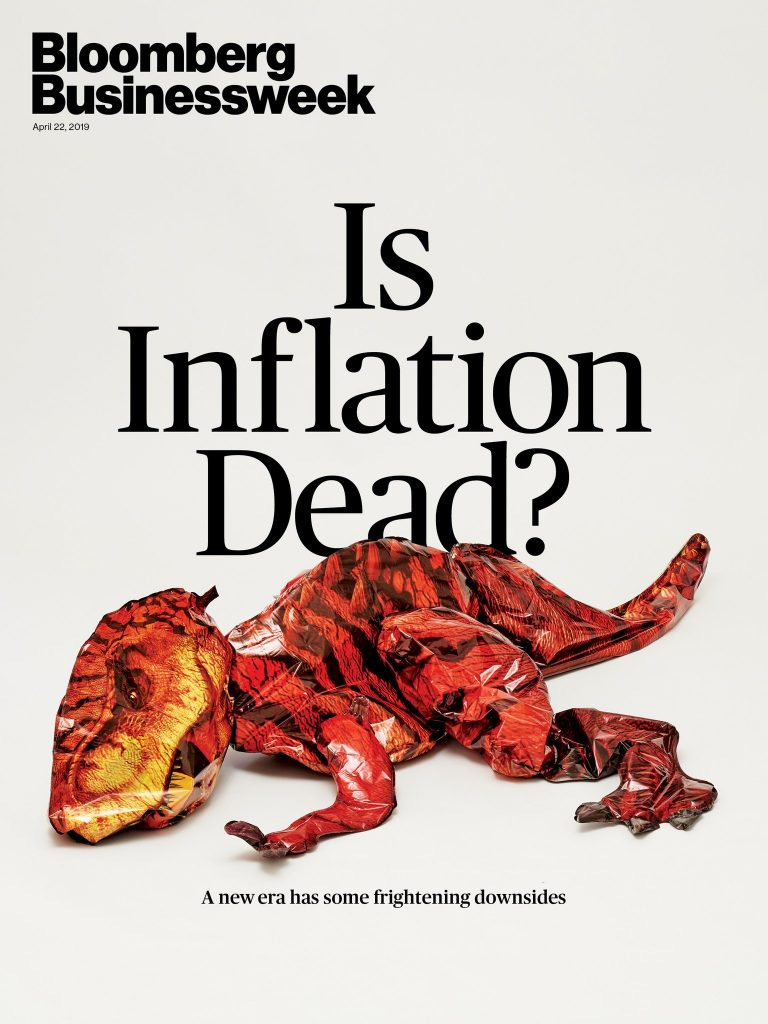

Fed and economists were puzzled by the lack of inflation. This headline from 2019 is telling:

So yes, Fed was afraid of the decline in the stock market but the reason for that was low inflation which would’ve fallen even lower without market stabilization action, preventing the Fed from fulfilling its mandate.

Monetary easing is boosting valuations of asset classes and wealth inequality so it’s understandable that it can be viewed as politicized actions. Today’s actions by the Fed go against the political bias demonstrating its independence. Demand destruction they are invoking is a synonym for financial pain or even ruin for the households. Fed is openly saying that unemployment is too low and needs to be higher which means some people will have to lose jobs.

Those steps are not taken easily but they are needed to fulfill the inflation-targeting mandate.

On the topic of independence, it’s important to note that everyone knows about Fed’s mandate including the market and politicians. That means that Fed can be manipulated.

If we take the pandemic, for example. The government of Canada unleashed enormous spending which would’ve significantly lifted bond yields if the Bank of Canada (BoC) refused to purchase those newly issued bonds. High bond yields would’ve further damaged the economy during the recession negatively affecting inflation and inflation expectations.

Based on BoC’s mandate they had to buy those bonds so the government used the mandate in their favor to force BoC. If inflation would’ve been high at that time it would’ve been a different story.

Central banks are like shooters who independently take their shots, however, by moving their target you can force them to shoot in a different direction.

Sound Money

During the last decade, Fed was criticized for its monetary policy actions causing the wealth gap to become wider and a loss of trust in the financial system. Products, such as cryptocurrencies appear to address these issues by providing an option for “sound money”.

It’s important to recognize that the latest actions by the Fed are a 180 pivot towards sound money. Instead of printing, they are extracting capital from the financial system. Instead of creating wealth primarily for the rich, they are destroying it.

It’s not clear if this trend is going to continue and for how long, but with the return to sound money there will be less need for alternatives.

Blame the Fed?

A number of economists question Fed’s actions today by saying that Fed can’t resolve supply issues. It is a healthy debate and indeed it does seem irrational to intentionally damage economic growth with momentary policy actions.

What those economists are missing in my view, is that the Fed has a clear mandate and a limited number of tools at its disposal. Like a good soldier, Fed is committed to fulfilling the mandate by using the tools available. Indeed, the Fed can’t resolve supply issues so they are forced to dampen demand because high inflation is simply unacceptable.

It was similarly irrational and non-optimal to fill in the markets with capital between 2008-2021 in an attempt to fulfill the same inflation mandate.

The center of those discussions must be the mandate itself and not the Fed. Maybe we should start a discussion about changing the mandate now and allowing higher inflation. That would be more productive than simply blaming the Fed.

Otherwise, Fed is just doing its job according to the job description.

Canada take notes

It is believed that Americans are obsessed with the stock market while Canadians are obsessed with the housing one.

Fed had the courage to hike 0.75% when the stock market was down by more than 20% from its peak. Don’t be surprised if the Bank of Canada is going to continue tightening into the housing market weakness.

The housing market has a bigger weight and risk for the overall economy than the stock market but the primary objective for the Bank of Canada still remains inflation targeting.

Rising bond yields and inflation - are global trends.