Battle for Millennials' Votes

Overview of the housing affordability topic and related election platforms of the 3 leading parties. (September 2021)

Disclosure: This article represents personal views of the author. I’m not affiliated with any party and haven’t received any form of compensation for publishing it.

Housing affordability is one of the leading themes in the upcoming election so I’ll share my thoughts regarding this topic and provide an overview of ideas presented in the housing platforms. Unfortunately, I haven’t found enough political will and concrete actions to resolve the issue so I’ll start with my conclusion:

Solution to housing affordabilty is unlikely to come from any Canadian politician

Now, when I said it, we can dive deep into details. First of all, let’s clarify the definition of housing affordability. The methodology I’m using is based on the share of household income required to be spent on a mortgage payment. When high share of incomes is spent on mortgages - the market is unaffordable.

How unaffordable is Canadian Real Estate Market today?

“Housing mania drives RBC’s affordability measure to its worst level in 31 years: RBC’s national aggregate measure rose for the third straight time in the first quarter of 2021, up 0.9 percentage points to 52.0%—last reached in 1990.” - RBC

The housing affordability issue reached the federal level but it’s still not a federal issue. Affordability is not uniform across Canada and housing in some places like Atlantic Canada is very affordable today. While help from the federal government is definitely needed to fight systemic issues such as money laundering, ultimately housing affordability should be addressed on provincial and municipal levels.

There are 3 components mathematically affecting affordability:

If you are puzzled by what “Lending Standards” mean - it’s a complex of lending rules such as the limit on maximum amortization, debt load (GDS/TDS), and also parameters like mortgage rates. This set of rules and parameters ultimately defines the maximum mortgage amount which can be provided to every borrower and the resulting monthly mortgage payments.

Affordability can be achieved by changing any of those three components or combinations, but there is a catch - improvement in any of those components is normally leading to higher demand which in turn boosts prices causing affordability to return back to where it was before or even worse.

Here are a couple of examples:

Jan 2018. GTA Benchmark price declined by 9% below the May 2017 peak. Affordability improved. In spite of the stress-test introduction, the market comes back to life and prices are accelerating. Lower prices attract more buyers pushing prices up and destroying affordability gains.

Feb 2019. Mortgage rates started declining in Canada improving affordability. This resulted in a strong year for the real estate market and continued mortgage rates decline through 2020 supported market strength even through the pandemic. The market got so excited and bid up the prices that not only fully reversed the improvement in affordability but made it even worse compared to Jan 2019.

Household incomes were boosted in 2020 by various financial support programs and pandemic-related savings. That improved affordability leading to more home buying activity. Demand increase caused prices to rise and affordability to deteriorate back.

All those examples are not perfect because the real estate market is always affected by multiple factors and it’s difficult to attribute the change in the market to a single one of them. However, there is a common sequence of events:

When analyzing election platforms ask yourself a question - will this change increase demand? If the answer is “Yes” then it’s not going to help affordability in the long run.

Here is the list of policies falling under that category:

In theory, it is possible to create a proper solution aimed to improve affordability however it’s very important to design it in such a way that will not increase overall demand, for example: help First-Time Home Buyers and restrict speculative activity at the same time.

In some way all parties are trying to do that and present policies leading to the reduction of housing demand:

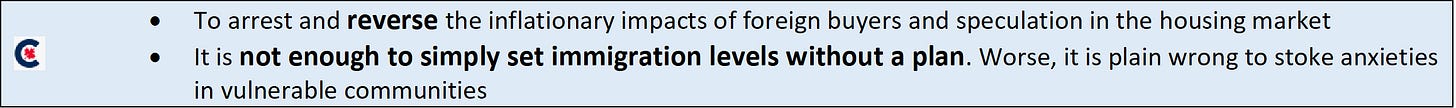

However, I highly doubt that demand restriction measures will be enough to offset the increase caused by the other policies. Also, foreign buyers are a “scapegoat” in my view. The real issue is not the buyers but foreign capital in general and no party is properly addressing it. Also, there will be numerous exceptions and loopholes in the policies.

How affordability can be permanently improved?

Based on the processes described earlier it seems that affordability can never be permanently improved because the market always “buys the dip”. This is a very important concept because that’s where market confidence and supply/demand balance come into play.

Affordability can only be improved permanently if there is a long enough shift in supply/demand balance such as significant demand destruction (for example due to high unemployment, higher interest rates, non-permanent residents outflow), or supply excess (for example when housing completions exceed household formations). However, the most important factor is market confidence. As long as the market believes that any weakness in the real estate market is temporary prices continue to rebound.

Are any election platforms going to destroy the “market always goes up” mentality or cause significant demand destruction? It’s very unlikely. The only potential solution is to oversupply the market with a massive construction, however, I highly doubt it will be implemented in the way it’s promised today, plus there are many bottlenecks in the construction process that won’t allow to quickly expand the number of projects, and even if they manage to do that it takes years to complete apartment buildings so no relief should be expected anytime soon. Regardless, on paper, supply increase is the only election promise(out of those presented) that may potentially cause permanent affordability improvement.

Here is the list of proposed supply-side measures:

Multigenerational Home Renovation tax credit proposed by Liberals is an interesting idea that is going to incentivize the private sector to provide additional housing supply.

Discussion about supply means very little without a discussion about demand and that part is missing from all election platforms.

Even if a lot of supply is delivered and overbuilding happens government has control over population growth and a simple increase in immigration targets will quickly arrest overbuilding preventing any affordability improvement.

Is there any party at least saying:

“We will boost the housing supply and we will also make sure population growth is carefully planned so the market can take advantage of this extra supply reversing some of the price increases and improving affordability”?

*** Silence ***

Conservatives came the closest with statements like this:

But this is very vague wording and could be just political talk.

That brings us to the statement I made at the beginning of the article that I don’t think any party will bring back housing affordability in Canada and the fact that politicians are trying to resolve it on a federal level speaks about how desperate things are. What can have a material impact on affordability then?

In my view here are some possible factors:

Significant external shocks such as recession, worsening of the pandemic, high inflation, war, major stock market crash, etc.

It is also possible that the market would start weakening with minimal/no catalyst just under the weight of its own overvaluation. Unfortunately, it’s impossible to predict at which level of overvaluation it is going to happen in every particular market.

Potentially, prolonged weakness in the rental market may spread to the resale market.

I’d like to emphasize that the high inflation risk is likely the most impactful one. In any other scenario, the government will just stabilize everything with additional spending, as they did in 2020. High inflation will cause bond yields to rise along with the government debt service expenses and discourage the Bank of Canada from printing new money (based on the current framework) making it much more difficult for the government to expand spending.

An unconventional approach to affordability solutions

It’s very unlikely that any party would dare to bring prices down. That means at best they will try to design a “soft landing” attempting to freeze real estate prices until fundamentals catch up. It requires at least 13 years for the Toronto fundamentals to catch up in that scenario (assuming 0% YoY prices growth, 3% YoY income growth, no change in lending standards).

The success of the “soft landing” is highly unlikely, in fact, there was an attempt to create one in Toronto in 2017 and here we are today in an even more unaffordable market.

What’s the alternative?

Bears can join the Bulls and support solutions that are going to increase demand causing prices to grow rapidly and affordability to deteriorate further. The logic here is that the more unaffordable the market is the more difficult it is to maintain excessive valuations and also the more vulnerable market is to various external shocks such as recession etc.

“The cure for high prices is high prices”

this approach is known in the commodities markets.

There are no guarantees here and no silver bullet but if the goal is an affordable market then it’s very possible it may be achieved sooner if Real Estate prices are allowed to grow unrestricted.

Today we are having a record low resale inventory (for this time of the year) and tight market balance in the GTA which means there is a good chance that we are going to see a strong upward move in prices soon, worsening affordability even more. Give it a couple of rate hikes in 2022-2023 and we are on a course to revisit or even beat the unaffordability of the 1989 bubble.

Is it possible to have a solution that suits both homeowners and homebuyers?

It is actually possible, but not in the free market and the solution is ugly. That’s the route Hong Kong has chosen. They protected high housing valuations and started massively expanding social housing to provide affordable housing to the population. Currently, social housing is home to about half of Hong Kong’s population.

The housing market was effectively split in two - a playground for the rich(market housing) and social housing for the rest. Proceeds from land sale & taxes for the former one are used to expand and subsidize the latter one. (BTW, whatever data you see for Hong Kong in the global Real Estate bubble rankings is only related to the market housing, so it’s not an accurate representation of the affordability picture.)

Do we want to follow the same model in Canada? Expansion of the affordable housing programs and housing-related government subsidies is the path towards this model.

In a free market with unaffordable housing interests of both homebuyers and homeowners can’t be met at the same time. On one side of the scale, there is financial well-being of all existing homeowners(including investors), on the other one is the homeownership perspective of exiting first-time homebuyers and also housing affordability for the numerous generations of future homebuyers ahead.

That’s the dilemma politicians are facing and that’s why there is no easy fix to the housing affordability issue. If they want to retain some form of free-market in housing then they have to pick sides. Usually, they just create visibility that they are working on an issue and throw in some policies which are politically popular but do nothing or provide short-term relief and that’s understandable because the majority of the voters are homeowners/investors. Unfortunately, that’s still my impression today from all the election platforms discussed here.

The good stuff

There are always 2 sides to the coin so for every policy there will be winners and losers but I’ll do my best to provide a breakdown of what’s good and bad from prudence, transparency, and affordability perspectives.

Supply boost policies discussed earlier are considered positive.

Demand reduction policies would be also good for affordability, however, there is a caveat, if foreign investors are currently buying pre-construction properties then this demand will be gone weakening future supply. Foreign buyers’ ban in the resale market sounds like a no-brainer but a ban in the new construction sector may potentially have negative side effects.

Here are additional good policies:

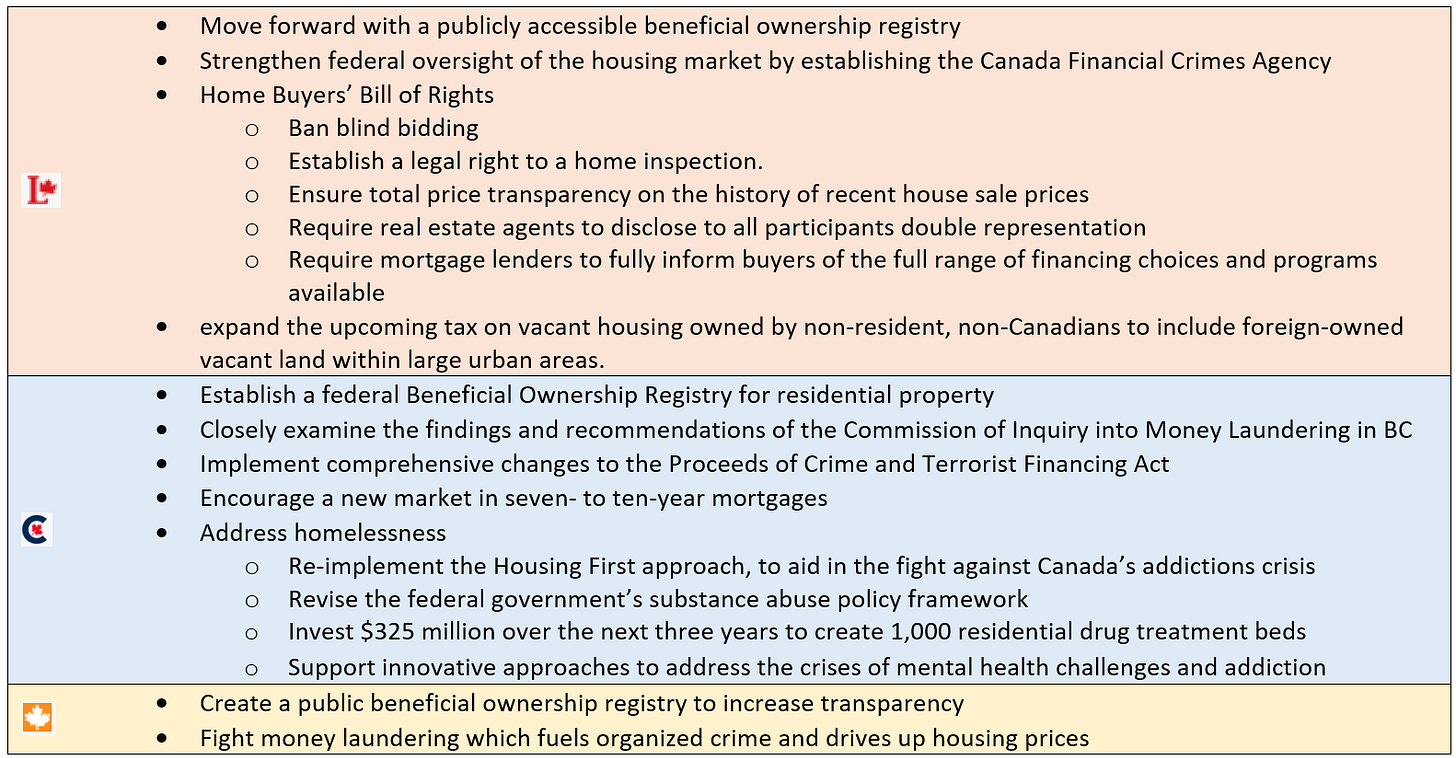

It’s great to see that all parties support beneficial ownership registry creation and anti-money laundering initiatives.

Bill of Rights proposed by Liberals is a great set of policies designed to improve transparency helping homebuyers.

The promotion of 7-10 years mortgage terms proposed by Conservatives is also a step in the right direction. Rising mortgage rates have two consequences: they increase mortgage payments and also reduce housing valuations. Longer mortgage terms will allow homebuyers to mitigate one of those risks. Since today global bond yields are the lowest in history in my view it’s a good idea to have protection from higher mortgage rates. A 25-30 years term mortgage (like in the US) would be ideal.

I will also remind you about the vacancy tax promise from the 2021 federal budget:

This is a very important change. Unproductive use of the housing stock is an excellent way to destroy housing affordability in undersupplied markets (like Toronto & Vancouver). When properties are not used for long-term housing accommodation those distort housing supply/demand balance and worsen affordability. That’s why policies such as short-term regulation or vacancy tax are so important, they discourage unproductive use of housing.

It doesn’t really matter if there are a lot of empty properties or not today, planes are equipped with life vests not because you are going to use them during every flight, but because you may need those in case of an emergency. Similarly, if the market is not oversupplied, it’s a good idea to have policies like vacancy tax and short-term rental regulation in place regardless if those issues exist or not, but to safeguard the market from the possibility of unproductive use in the future.

Expansion of this policy to vacant land around big cities sounds like a good enhancement.

The bad stuff

Policies boosting demand discussed previously would fall under this category. They will have a short-term affordability relief but it won’t be a longed-lived one.

Overall I don’t see very bad policies in any of the election platforms. Very bad ones would equip homebuyers with larger debt in order to compete with investors and also each other. Amortization increase from 25 to 30 years for CMHC insured mortgages proposed by NDP is a step in this direction but it may be justifiable since maximum amortization for non-insured mortgages is 30 years. In this case, it’s more of a leveling playing field. Amortization increase beyond that would be a major red flag. Since it’s a demand-boosting policy it won’t achieve affordability in the long term but will burden homebuyers with higher levels of debt.

Conservatives are proposing to ease stress-test parameters which also falls under lending easing measures. I don’t consider it very bad for 2 reasons.

1) Affordability is calculated based on the actual mortgage payments and not qualification so basically real estate market is unaffordable assuming there is no stress test at all.

2) Currently there are a lot of workarounds allowing to avoid the stress-test for those who want to purchase a property.

Stress-Test easing or removal should definitely boost demand but fundamentally it shouldn’t be a material boost. However, market perception of all changes is crucial.

As a rule of thumb policies related to lending conditions easing fall under the “very bad” policies since those result in more indebtedness and fail to achieve affordability in the long run.

Liberals are proposing to expand use cases for mortgage deferrals.

Like every policy, it has some goods and bads. While the good part is obvious here I’ll explain why I put it in the “bad stuff” bucket. Deferrals help homeowners to overcome short-time financial shocks but they also create a moral hazard and encourage risk-taking.

Should we really allow an investor with 5 mortgages who took a huge risk without performing any risk planning and having contingency funds to defer all those mortgages in case something goes wrong? Will it encourage the same investor to purchase another 5 properties outbidding homebuyers?

To sum it up, in my view this policy should be extensively fine-tuned in order to provide support while minimizing moral hazard issues.

Keep an eye on the NDP

While NDP is not expected to win a majority there is a potential bombshell in their toolkit.

Appreciation is absolutely a huge part of real estate investors’ expectations in markets like Toronto and Vancouver so policies like this have the potential to cause a big impact by reducing demand from investors and even trigger a sell-off.

Climate Change

While housing affordability seems to be the most discussed topic today and it is on the top of everyone’s mind please don’t forget about other issues like climate change. Affordable housing is not going to be very useful on an uninhabitable planet.

Links to the housing section of election platforms: