Central Bankers Race to Cut Interest Rates

Overview of important developments in the Toronto Metro housing market and macro reported in September 2024

Highlights

The slowdown in Toronto Metro’s real estate market continued in September, driven by an increase in new listings.

The Toronto Metro rental market weakened significantly during the fall student intake.

September was a month of interest rate cuts.

Is the Bank of Canada falling behind the curve?

Who will benefit most from the new mortgage reforms?

Housing affordability has improved, particularly with the switch to 30-year amortizations.

Where are the buyers?

Population growth in Canada slowed in Q2 2024.

New restrictions were added for international students.

Real Estate Market

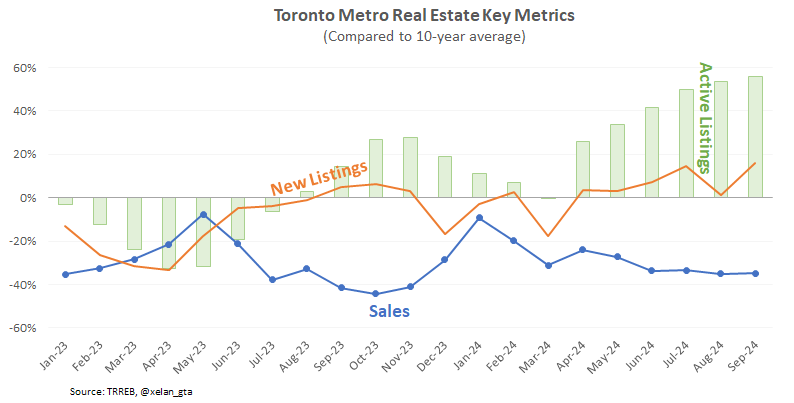

After showing some signs of stabilization in August, the Toronto Metro real estate market continued to weaken in September. Sales remained flat, while new listings and active inventory increased compared to the 10-year average.

Market balance indicators also remained largely unchanged under the same comparison.

Both median and average prices rose in September, but the benchmark price declined.

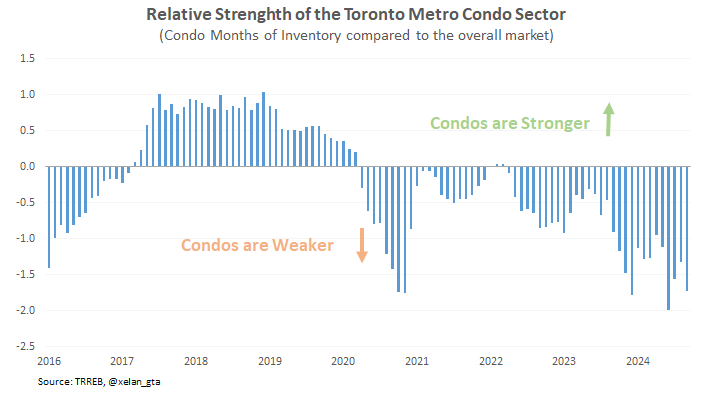

The condo sector continues to perform worse than the overall market and deserves close attention, as its relative weakness is becoming more pronounced.

Despite this growing gap, there has been no significant divergence in price trends between condos and the broader market. This is a prime example of price stickiness on the downside, though it's unlikely to be sustainable, given that the condo market balance is the weakest it has been since 2009.

The condo sector should continue facing higher downside risks in the coming years due to the expected high number of completions, a potential decline in population growth and unattractive investment math.

I'd like to clarify a few points about the current state of active inventory. While resale inventory is elevated, it doesn't appear to be at an alarming level yet. When adjusted for population growth, it's still well below the 2008 peak.

However, what often goes unnoticed is the growth in active rental inventory, which is currently much higher than historical norms.

Keep reading with a 7-day free trial

Subscribe to Toronto Real Estate Analytics to keep reading this post and get 7 days of free access to the full post archives.