Financial Pressures are Mounting Due to Rising Rates

Overview of important developments in the Toronto Metro housing market and macro reported in October 2022

Note: if you can’t see the full text of this article in your email, click on the title of the newsletter to access the full version.

Toronto Metro Resale Market

Overall, Toronto Metro real estate market didn’t change much in October compared to the previous month, however, there were some potential signs of market weakening.

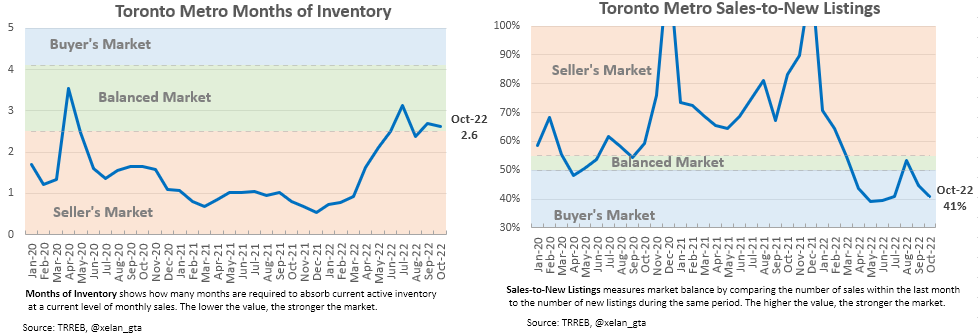

Market balance indicators were sending mixed signals

however, after seasonal adjustment both of those weakened a little.

Price metrics were also a mixed bag with some of them still declining and some increasing.

They stabilized around 20% below the peak for several months which gave benchmark price (a lagging metric) time to catch up.

Active inventory slightly increased on a seasonally adjusted basis but remains historically low.

Toronto Metro Rental Market

Rental Market performs in line with expectations. Rent prices stopped growing mostly due to seasonality.

Market Balance is traditionally weakening during this time of the year

and the seasonally adjusted underlying trend continues to weaken as well. In my previous newsletter (link) I shared more details about that development, and it continued in October.

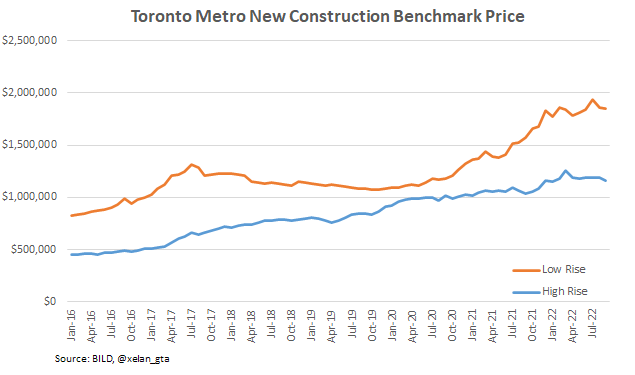

Toronto Metro New Construction Sales

New construction sales came to a standstill.

That is understandable due to declining resale prices and also the availability of distressed pre-construction sellers who are selling their units even below resale prices.

New construction prices need to come down to become competitive and it hasn’t really happened yet.

Unsold inventory is starting to creep higher, however, remains historically low.

First Downard Revision to Inflation Projection since 2020

Bank of Canada, in their October MPR, revised down inflation projection for the first time since the start of the pandemic. This is an important milestone.

Mortgage Rates and Their Impact

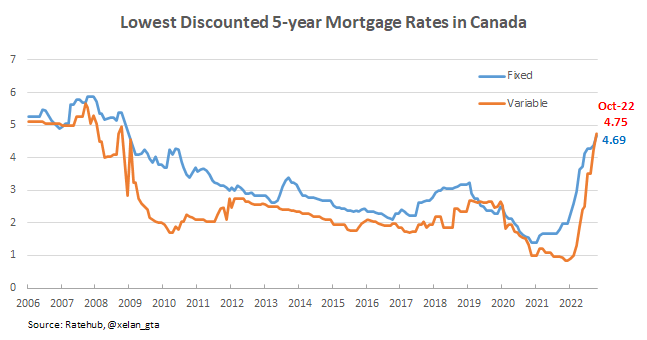

Bank of Canada also raised the policy rate by 0.5% in October lifting variable mortgage rates. Fixed mortgage rates increased as well resulting in the lowest available discounted 5-year mortgage rate of 4.69%, a level, that hasn’t been seen since 2008.

As a result, Toronto Metro’s housing affordability and real estate investment attractiveness deteriorated even further, setting new records (more on that below). Fundamentals are telling that prices are too high for the current level of mortgage rates/bond yields which explains low sales. Demand is not expected to recover until fundamentals change.

On the supply side, new listing activity remains artificially low. With prices already 20% below the peak, sellers simply don’t want to sell and prefer to wait. With the mounting financial pressures, the question is how long they will be able to wait and it’s likely in my view that we are going to see some property owners being forced to sell under the mounting financial pressure. That could start tipping the market balance scale towards the buyer’s market territory causing a further decline in prices. I’m carefully watching the signs of this development. Unlike the sharp inventory increase earlier this year driven by voluntary listings, a further increase is likely to be gradual, driven by those who are being forced to sell.

The question is what realistically sellers could be waiting for. If we don’t run into a recession, interest rates in the US don’t expect to materially decline below the current level until 2025. (I’m using US data due to the lack of access to the identical Canadian one.)

If sellers are expecting rates to decline significantly and soon then it would likely be accompanied by a recession that is deeper than expected. Recession is typically not a favorable environment for housing markets.

The only real upside risk for the next couple of years in my view is government intervention. The Canadian government supported the housing market many times in the past and it shouldn’t be a surprise if they do it again, despite high inflation.

In fact, they already started doing it. On Nov 1, 2022, the Government of Canada revised up immigration targets for 2023-2024.

It’s absolutely impossible for the Toronto Metro construction industry to deliver additional units to accommodate the 2023 & 2024 upward revisions so this change will clearly tighten housing markets even if it’s not the primary goal of raising immigration targets.

Here is the insight on this topic shared by macro analyst Ben Rabidoux:

Besides that, the government has been quite reluctant to intervene so far this year, allowing house prices to decline in Canada.

Terminal Interest Rate of 5%

Terminal Rate is the maximum interest rate expected to be achieved during the tightening cycle. After the latest hike by the FED market is pricing in a terminal rate above 5%.

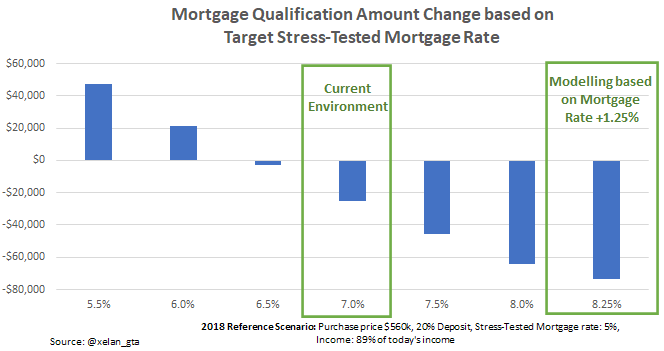

While interest rates are not expected to stay at the terminal rate permanently, I’d like to show the impact of the 5% interest rate in Canada to demonstrate the financial hardship it causes. For that modeling, a 5% interest rate corresponds to a +1.25% mortgage rate increase above the current levels.

Mortgage Renewals

People who bought properties 5 years ago with fixed mortgages and facing their first renewal should currently expect about $560/m mortgage payment increase. With a +1.25% higher mortgage rate payment would increase by about $910/m.

Payment increases as a result of mortgage renewal are not just limited to 5-year terms. All mortgages are affected today however modeling was done only for the 5-year term.

Trigger Rate

For variable mortgages with fixed payments (VRM) trigger rate is a rate at which interest payments exceed total mortgage payments on the original contract so mortgage payment doesn’t cover interest anymore. You can read more about it here.

Rising mortgage rates are starting to hit the trigger rate for recent buyers with VRM mortgages who purchased properties between Mar 2020 and May 2022. They are facing interest payments of about $350/m higher on average than their total contract mortgage payment.

Modeling for an additional +1.25% mortgage rate increase is drastically changing this picture. Now homebuyers who purchased a property with a VRM mortgage between at least Jan 2020 and Aug 2022 will be facing interest payments about $1100/m higher on average than their total contract mortgage payment.

Private Lending

It’s becoming increasingly challenging for those who have private mortgages to switch to “A” lenders and even renew their term. With rising mortgage rates, it will become even more difficult. The share of private mortgages among total recent ones is expected to be in the ballpark of 10%.

New Construction

Rising mortgage rates are making it more challenging for pre-construction buyers to obtain a mortgage and close their deals. Modeling shows that despite 12.5% income growth since 2018 pre-construction buyers need to add about $25k to qualify for the same amount as it was in 2018 when they made pre-construction purchases. A further +1.25% increase in mortgage rate will bump it to about $75k.

For those who are unable to obtain a mortgage assignment sale could be an alternative. Most of the new construction buyers should still have significant equity so this market is not a big concern at the moment (it could definitely become one in the future).

Non-Mortgage Debt

The interest rate on non-mortgage debt fully recovered to the pre-pandemic level in Aug 2022 and most definitely exceeded it since then. That means borrowers across Canada are facing payment increases not only on mortgages but also on various non-mortgage products. Further interest rate increases will create additional cash flow pressure.

Household Debt Service Ratio

Household Debt Service Ratio (DSR) is useful for a historical comparison of the overall debt payment pressures among Canadians. It shows a percentage of income spent on servicing debts and is averaged across all households including those which have no debts.

Modelling shows that if today’s interest rate of 3.75% sustain it will raise DSR to record-high levels. The interest rate of 5% will lift it even higher.

Interest Rate Sensitivity

Due to the higher amount of debt compared to the past Canadian households are more sensitive to interest rate increases. The current environment is already the most restrictive in the last 25 years with nearly 7% (700bps) of effective tightening and further interest rate increases will make it even more restrictive.

Housing Affordability

The Toronto Metro market is extremely unaffordable for new homebuyers today. Adding 1.25% to mortgage rates will make affordability even worse.

Real Estate Investment Attractiveness

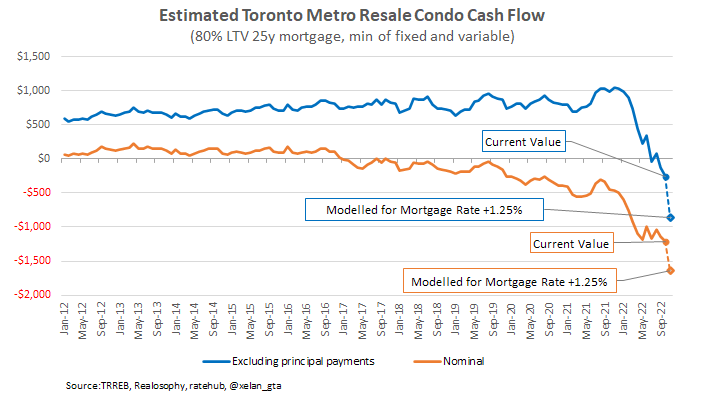

Cash flows for new Toronto Metro condo investors are very unattractive historically. A condo investment purchased today not only has negative cash flow, but it will lose about -$250/m (estimated average) even if the principal portion of mortgage payment is not counted as expenses.

If mortgage rates rise by +1.25% losses accelerate to -$850/m. Total cash flow would be about -$1,650/m negative.

Cap rate is one of the metrics of real estate investment returns which is calculated as annual net rental income divided by property purchase price. The estimated spread between Cap rates and mortgage rates is already negative and will approach -2.8% if mortgage rates increase by another +1.25%.

Summary

Toronto Metro real estate market remained balanced in October. Different metrics are sending different signals however overall, there are some signs of weakening. Data is noisy so it’s impossible to make a definitive conclusion yet however it’s interesting that unlike October in September market was also sending mixed signals but was on the stronger side (link). It could be an indication that the market is turning south but let’s not read tea leaves too much, November could bring more clarity here.

Overall Market balance indicators slightly declined on a seasonally adjusted basis and active inventory increased. Prices remain about -20% below the peak and about -5% down compared to last year. Low active inventory continues to remain a major headwind for the sustained housing correction which should keep all Bears cautious.

Toronto Metro rental market continues to gradually weaken. Rent prices are unchanged for the last 2 months mostly due to seasonality. The market is not as tight as it was earlier this year, but it remains tight.

Mortgage rates continue to march higher with both fixed and variable mortgage rates increased in October. Affordability for homebuyers and attractiveness for investors continue to deteriorate to new lows setting new records.

The market is becoming increasingly hawkish and pricing in higher and higher terminal rate which exceeded 5% in the US. While it could be justifiable to fight inflation it’s important to remember about the debts in Canada and high interest rate sensitivity. I performed modeling for a +1.25% further increase in mortgage rate to demonstrate what financial hardship is going to create. The resulting cash flow pressures are enormous and measured in thousands of dollars of additional expenses per month. The impact is also not linear so small further rate increases will be causing significantly more impact.

Even today, cash flow pressures are absolutely unprecedented and haven’t been seen in Toronto Metro for at least the last several decades. No doubt savings are being depleted right now, so the only question is how long they are going to last.

As a part of inflation targeting Bank of Canada is aiming for higher unemployment which should add challenges to those who would be unfortunate to lose their job.

Despite the strong labour market today some occupations, like Real Estate Professionals are already seeing income reduction.

Capital Market performance adds to the financial pressures.

So, while inflation remains at the center of attention, it’s easy to see how real estate investors and homeowners can start breaking under the weight of financial pressure, especially if mortgage rates increase even higher.

A petition, initiated allegedly by a group of realtors already got almost 50k signatures. Even if proposed solutions could be laughable, it is an important indicator of the mounting financial pressures discussed previously.

I remain very cautious in this environment. The higher the interest rates increase in the coming months the higher the chances of the economy hard landing and the severity of that landing. Price stability is the priority number one for Central Bankers, as it should be, but it will come at a cost.