The Current State and What's Next for the Toronto Housing Market? (Part I)

A special edition related to the weakening of the Toronto Metro real estate market, impact of the rising rates and new budget. (April 2022)

Toronto Metro real estate market started weakening and there is so much uncertainty about what’s going to happen next. More and more people are asking for guidance so I decided to create a dedicated post and share my thoughts regarding the current environment and potential outcomes.

This post is a logical continuation of the topics related to the 2021 election platforms(link) and inflation(link) I covered previously so I’ll start with the idea I expressed in one of those posts:

I must admit that market conditions aligned exactly as described to have this idea tested. Even though housing affordability deteriorated to an extreme level it doesn’t guarantee that sustained and material price correction follows.

As I‘m learning more about real estate analytics my views are constantly evolving so here is what they looked like before every Toronto Metro market weakening episode:

2017 - market sentiment change is required for affordability reversal to the mean

2020 - permanent demand destruction (high unemployment and defaults) required for affordability reversal to the mean

2022 - permanent demand destruction and government inability to support the market are required for affordability reversal to the mean (alternatively policy error or political will to bring prices lower).

Here is an example of my post on Twitter done at the onset of the pandemic.

I was paying attention to the government’s actions back then but truly underestimated their ability to stabilize the whole economy so I’m adding it now to the prerequisites list. The point is, take all analytics with a grain of salt.

Toronto Metro real estate market slowdown measured

A lot of stars must align to have a meaningful price correction and we are nowhere near yet. So where are we? What’s the exact state of the market? I provided a pretty detailed snapshot in my latest newsletter (link) but I’ll bring more clarity by comparing to previous episodes of housing market weakness.

Here is the comparison of market statistics between the 2022, 2007, and 2017 slowdown episodes:

The current levels of active inventory and Months of Inventory (market balance indicator) readings are significantly lower than the highs seen in 2017 and 2007. For a meaningful and sustained affordability improvement, I believe both of those metrics must exceed 2008 levels.

Here is the pace of active inventory accumulation by each month.

Today’s pace is not unprecedented and in 2017, it led to a market slowdown and temporary price correction but not a meaningful sustained one.

Also, if we look at all data, there were several more episodes of such inventory growth throughout history.

So the current level of inventory accumulation definitely deserves attention but it doesn’t justify panic or lead to a conclusion about the imminent market crash.

What’s required for sustained and meaningful price correction?

Now, when we are clear about the current market state I’d like to elaborate on why I think overvaluation may not be enough to cause a sustained price correction. I touched a little bit on that topic in one of my articles mentioned previously.

Even though market confidence could be changing today, any price decline will be seen as a buying opportunity and the government is still protecting the housing market at all costs so, in my view, any sentiment changes will be temporary, similarly to 2017, and as soon as prices decline by 15-20% sellers will just stop listing and prevent further inventory growth stabilizing the market. I could be wrong here and will be closely watching the 20% price decline threshold.

For a sustained price correction, people have to be forced to list against their will which usually happens due to significant prices drop, job loss, or bankruptcy. Those types of events require a recessionary environment therefore until a recession occurs any talks about material and sustained affordability improvement are preliminary in my view.

2020 showed that recession alone is not enough because the government has enormous power to stabilize the economy and prevent defaults and other negative consequences. It requires a lot of cash and they seem to be willing to spend it.

That part concerns me the most because they can try to play the same script during the next recession, so in order to have a sustained price correction, there must be something that will prevent the government from stabilizing the real estate market.

What can possibly tie the hands of the government?

Possible things are:

Change in the political will. This is very unlikely with the current government

Policy error. (Underestimating the housing market weakness, delaying the deployment of support measures, etc.) I wouldn’t bet on that either, definitely possible but not the highest probability.

The situation when the government has no choice or only has bad choices and must select one of them. That is the only material option in my view so we need to explore if there are conditions for such a situation today.

The big difference in today’s environment compared to 2020 is inflation. It completely shut down the ability of the Central Bank to print money and switch them into a tightening stance.

That would make any funding for new government debt more difficult in the future until inflation goes down. If the government decides to support the housing market while inflation expectations are still high they will have to sell bonds to the public. In fact, the Bank of Canada announced in April 2022 that they will be reducing government bond holdings. That is a challenge but I don’t think it’s a show stopper, if the government wants to raise money and spend, they will do it one way or another. However with rising bond yields globally there will be more pressure on the budgets to service growing debt.

Another potential condition is a sustained shift in supply/demand balance. If completions significantly outpace household formations it would be difficult for the government to fix this mismatch, especially if unemployment is high at the same time. Such a condition is quite possible as a result of the recession but without it, I don’t see anything currently pointing to the material supply/demand mismatch. Again we come back to the recession being a prerequisite.

What keeps me up at night?

Despite all that, the government has numerous ways to support the housing market.

The government dropped immigration requirements virtually to zero in 2021 to meet the immigration target. What can stop them from easing mortgage requirements and, for example, introducing US-style NINJA loans if they really need to support housing?

That’s what keeps me up at night. I’m not confident that even with such massive overvaluation, some shift in sentiment and recession affordability of the Toronto Metro market will sustainably and materially improve. Government is 200% committed to supporting housing so it’s very difficult to bet against that as we learned in 2020. Also, at the beginning of the pandemic housing overvaluation was mostly a Toronto Metro & Vancouver Metro issue, now it’s lifted to a national-level bearing a higher risk and requiring more attention from the policymakers.

What about the Bank of Canada?

I covered topics of inflation and the interaction between inflation and Central Banks quite extensive in the post I mentioned previously “Inflation: Solution or Problem?” (link)

Bank of Canada raised its interest rate by 0.50% on April 13th, 2022 which is a very important milestone and the second hike in a row after a 0.25% increase in March 2022. It is also the biggest one-time hike in the last 20 years so it’s not an ordinary event. To me, it shows that concerns about housing markets and debts are secondary and inflation is a primary focus of the Central Bank, as it’s required by the mandate. I warned in one of my posts on Twitter that “Stock/Real Estate markets, you are on your own now” and provided the following explanation:

Bank of Canada reinforced my view and I would extend this warning to households and businesses.

0.50% rate hike also marks an important shift in my view from excessive printing to sound money, something that Bitcoin & Gold investors who are betting on financial system collapse should be watching carefully. I don’t know how long the current stance will last, it may not last long, but it is important to see that finally, Central Banks react to inflation in the way it is required by the mandate even if it causes some damage to the economy.

Will the Bank of Canada crash Canadian Housing?

They absolutely can and in my view will likely cause significant damage to the housing market or potentially even collapse it. Rising mortgage rates fundamentally should lead to lower prices(all else being equal), that’s just the math.

During the press conference(link), Tiff Macklem indicated that the destination for the interest rate hikes should be expected in the 2-3% range. It’s not a predefined path but it’s a real possibility so let’s pause here for a second and do some calculations.

The Math

I’m going to take the starting point as the end of 2021 when the discounted variable mortgage rate was at its lowest at 0.85%.

Important note: Calculations for fixed mortgage rates are outside of the scope because there is no forecast for those. Since both fixed and variable mortgage rate options are available for the buyers, the real picture will be different compared to the one presented below.

We’ll take a market snapshot at that time and calculate how much real estate prices should decline to retain exactly the same affordability with interest rates in the 2-3% range. The result comes down to -18% for a 2% interest rate scenario and -27% for a 3% one.

However, today’s prices are higher compared to December 2021 so if we take today’s prices and calculate prices retraction to the affordability level of December 2021 here is what it’s going to look like. Prices should decline by -28% in case of a 2% interest rate and -36% for a 3% one.

This is not a crash scenario but just a fundamentally calculated pullback in prices which is fully expected and shouldn’t surprise anyone. The Bank of Canada is fully aware of that impact. The calculated price decline is not going to bring the Toronto Metro market to affordable levels but just to December 2021 affordability level which was unaffordable back then, to begin with. This is the reason why I’m trying to use the “affordability improvement” term in my article rather than “price decline” because even if prices decline it may not lead to affordability improvement.

Also, this is just a theoretical calculation, prices are sticky on the downside and do not necessarily follow fundamentals, however, if the prices are going to decline less than calculated here (given mortgage rates rise that much), affordability will deteriorate beyond the December 2021 level. That’s exactly what happened in 2018 in Toronto Metro, affordability deteriorated beyond the 2017 peak.

That explains why so many new listings show up on the market. Higher interest rates are never good news for real estate prices growth.

Why Bank of Canada is raising rates then? Like many Central Banks, they are in a situation when on one hand they have high inflation that requires higher interest rates, and on the other hand asset bubbles and debts which would suffer from higher rates. This is a situation when you need to choose between two bad outcomes and that’s the environment where the risks of a policy error are high. Unlike earlier during the pandemic, markets are not buying into the “transitory inflation” tale anymore and aggressively sell bonds in anticipation of higher inflation in the future. Bank of Canada’s models, the market, and mandate tell them that rates need to rise. Their credibility is at stake so they are forced to hike. Without credibility, the Central Bank becomes useless and loses all control so it’s absolutely crucial to maintain it.

Another reason to hike is the rise of variable rate mortgage originations in Canada. A high share of variable rate mortgages represents a systemic risk.

High inflation is also eroding consumers’ confidence.

This data is from the US but it shows how important it is to bring inflation under control.

It doesn’t mean that the Bank of Canada just blindly follows the market, they are trying to do their best and use the models to analyze the impact. If the models tell them that a rate hike will lead to deflation down the road - they won’t do it and try to communicate their findings to the public. I’m expecting very soon we are going to see a study by the Bank of Canada with a detailed analysis of the impact of higher rates on households and their ability to handle those higher rates. Bank of Canada will create a forecast for unemployment, defaults, etc. to make sure the monetary policy path is adequate.

Inflation is currently high so some level of defaults and unemployment could be welcomed, again it all comes down to the results of their modeling. If those say, for example, a 0.1% rise in defaults will bring inflation from 4% to 3% that means the Bank of Canada should continue tightening despite those defaults.

Here lies the issue: Models can’t account for factors such as fraud because it’s simply unknown. If someone specifies 100k income in a mortgage application but makes 50k, there is no way for the Bank of Canada to know about that. The higher the share of fraud, the more unaccounted risk exists. In addition to fraud, people are finding legal ways around safeguards, for example, adding a co-signer to pass the stress-test so its resilience is likely overestimated. Another challenge is the lack of good statistics for private lending. Plus the models can’t accurately account for all factors, gauge sentiment, and also calculate how risks feed into each other. For those reasons risk most definitely will be underestimated. And that’s what potentially may lead to overtightening and housing market weakness beyond the Bank of Canada's projections.

A similar situation happened in the US leading to the 2008 housing crash. Central Bank was fully aware of the housing market weakening but underestimated the risk and was raising rates to combat inflationary pressures at that time.

Timeline

Timeline is a very important topic. Rates are rising very rapidly and are expected to increase significantly by the end of the year. Even if we assume that rate hikes may lead to the housing market collapse should we really expect it this year?

As I mentioned previously I believe we need to see a recession before we can talk about significant and sustainable price declines. While there are signs of a late cycle, a recession is not here yet and no consensus on when it’s going to occur.

The debt Service Ratio, which is an indicator of debt payment stress for households is well below the peak levels (Q4 2021). People repaired their balance sheets during the pandemic.

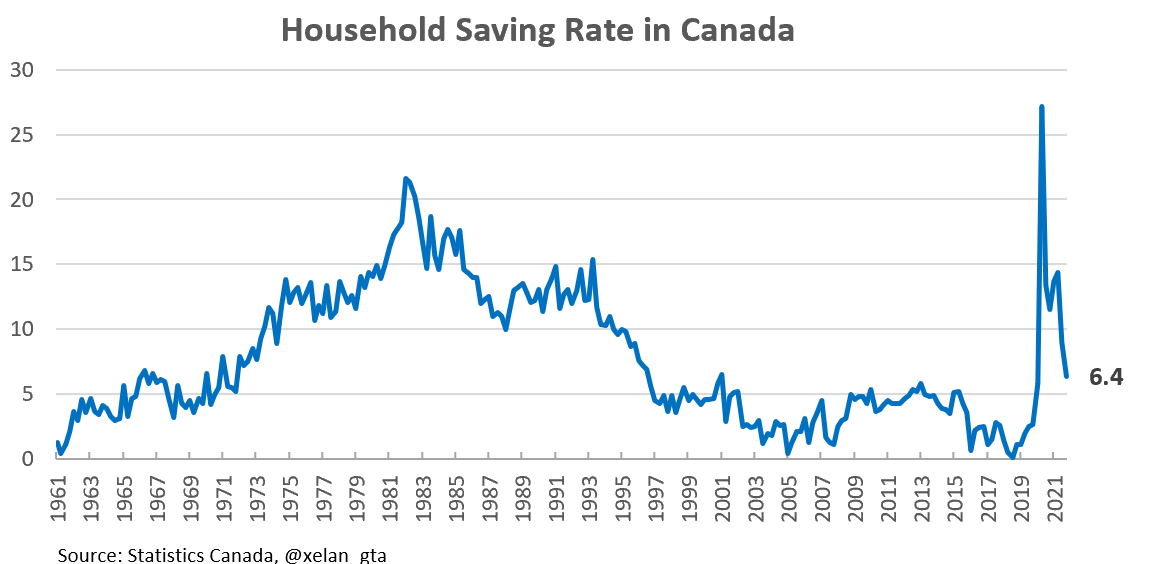

Household savings rates are still high (Q4 2021) so households continue to save and should have some financial cushion to meet higher interest rates, at least for a while.

In addition to the overall picture, it’s important to know distributions for those metrics to analyze the risk but that’s outside of the scope of this article.

It is also a known fact that interest rate increases take some time to make a full impact - 7 quarters on average.

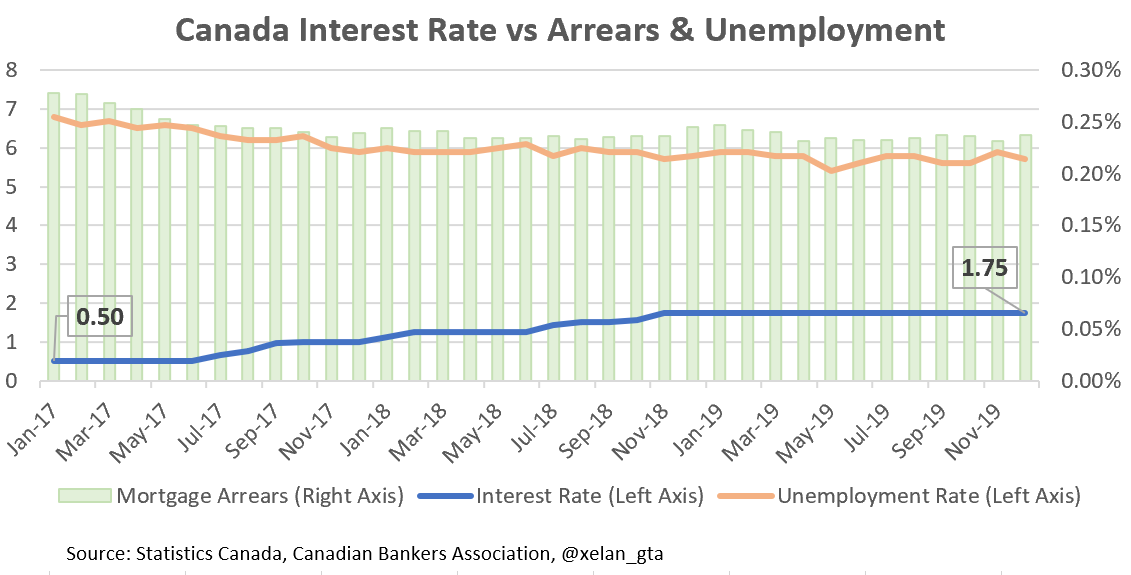

Referring to the historical examples, if we look at the previous market tightening episode in Canada there was no increase in mortgage arrears and unemployment at all as a result of 1.25% interest rate increase (at least not within 12 months).

Another example is the 2004-2006 tightening episode in the US. Rates went up by 4.25% over the course of 2 years. It took another year for the first signs of stress to show up in defaults and the unemployment rate didn’t even show any warnings. It took the real estate market 3 years to develop conditions for a sustained and material price correction.

Today's rate sensitivity is higher due to higher debt levels but it still takes time for structural weaknesses to develop. People will hold on for as long as they can.

A simple measure - Mortgage & HELOC deferral, which was successful in 2020 can postpone the negative consequences of rate hikes for many households beyond 2022.

So it puzzles me a lot when people say that something will break much sooner than the Bank of Canada completes tightening this year forcing them to cut rates again. I’m not saying it’s impossible but the main reasons I see for that would be:

Such a dramatic market sentiment shift in the housing market that price declines raise a systemic risk (30%+)

Recession in 2022, which is currently just a guess.

Other unexpected deflationary factors, leading to lower target policy rate expectations by the market.

Factors, that fall outside of my (and the market’s) analysis but are picked up correctly by people making that call.

I fully understand and agree with the debt levels concern, but I just don’t see the impact surfacing so soon. It is more likely that the Bank of Canada will tighten this year and even if the housing market reacts immediately macro indicators monitored by the Bank of Canada may only start seeing an impact next year.

Sales collapse would be totally expected soon, but how can we know what sellers are going to do if they have no constraints? At the onset of the pandemic, sellers pulled away from the market along with the buyers.

The myth about market rebounds

Usually, when prices fall, they rebound after, however, that shouldn’t be the case when significant price drops occur in very unaffordable markets. In order to understand why, you should ask the question “If the market is unaffordable, how it is sustained?” Logically, the more unaffordable market becomes, the less demand should exist but that’s not happening. Today Toronto Metro sales are 20% above the 10-year average.

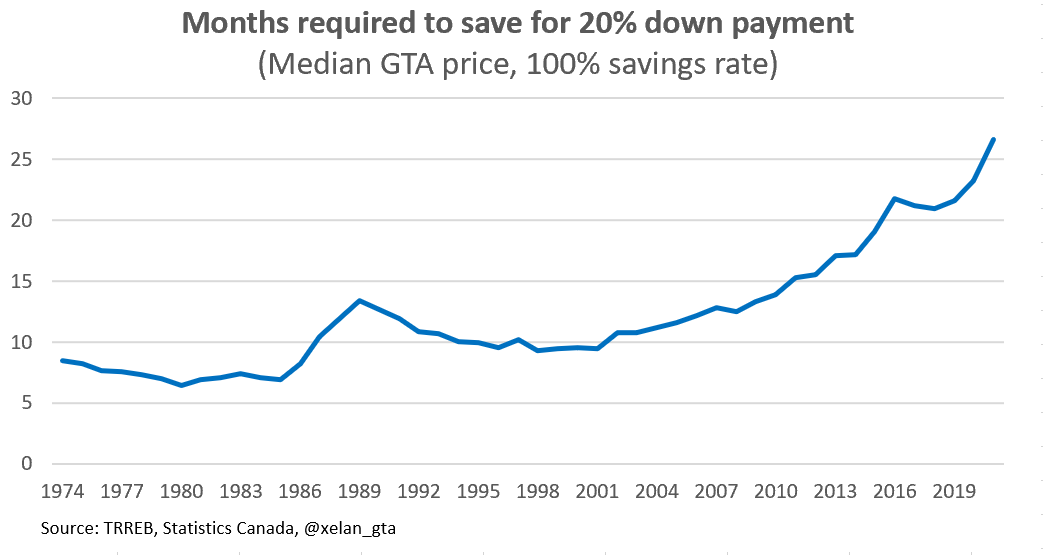

Sales are booming when the time required to save for 20% down payment is unprecedented.

And despite that more buyers put 20%+ down payments.

The only logical explanation is that in addition to savings, the growing share of the down payments comes from other sources. Those sources include capital market gains and equity from other properties.

Pulling equity from a parent’s house to help kids to purchase a property became a norm in the GTA. That’s one of the major explanations for how this market is sustained and why down payments are becoming bigger and bigger.

When the market undergoes a significant correction, that source of down payments is gone and gone for a very long time because a lot of equity disappears and price growth is required to be able to start pulling equity again. Also, usually, people become scared after financial losses and don’t even want to do it anymore. At the bottom of the correction, the market is stabilizing on a new set of fundamentals - sustainable ones, where people need to actually save their own money to buy a property. That’s why rebounds after significant corrections always take a very long time, usually decades.

Budget 2022

As we’ve seen with election promises those are pretty meaningless and have minimal or no impact on housing affordability improvement. The only measure from the budget I would keep an eye on is related to assignments taxation:

New condo sales for April would be an interesting indicator here. It should be expected that new condo sales decline, reducing future supply. The measure can also lead to a higher volume of existing assignment sales. I don’t have any expectations here because I don’t know the current volume of assignment sales tax exceptions and that’s a key factor here.

Overall I continue to maintain my view:

Therefore I’m not going to go into more details here, will only mention that I’m not optimistic about supply-related measures because there are a lot of constraints.

Summary

The real estate market in Toronto Metro is extremely unaffordable representing a significant risk, however, risk alone doesn’t guarantee that sustained and material housing affordability improvement follows.

The Bank of Canada did back-to-back rate hikes of 0.25%, followed by 0.50% to combat inflationary pressures. That is an important milestone for bank independence, priorities, mandate and shift away from printing towards “sound money”. They underestimated the inflation trajectory and also intentionally started raising rates much later than they would normally do. That strategy backfired and now they have to play catch-up.

Central Bank is currently expecting a target for rate hikes in the 2%-3% range which should fundamentally lead to the housing market weakening and price declines to retain the same level of affordability.

In response to the rising mortgage rates and anticipation of a slower market ahead, sellers increased activity and started to fill the market with new listings. As a result, active inventory is growing much faster than seasonality but so far the rate of growth is in line with the one we saw in 2017 and we are starting from a much lower level. Active inventory changes are expected to remain in the spotlight in the coming months.

Taking all factors into account a price correction in Toronto Metro is possible and even likely, however, at this moment, I see no evidence that correction will lead to a significant and sustained affordability improvement. It is absolutely possible, but can’t be determined with a reasonable degree of certainty right now.

It is fully expected that sales will decline in the coming months, potentially quite significantly and inventory continue to grow. That will likely lead to some price drop but it would be crucial to watch sellers’ behavior around the 15-20% price drop threshold. While panic-related new listings activity is possible at that point, the higher probability in my view is that new listings activity starts declining to stabilize the market. That’s assuming the economy is healthy and there are no recessionary developments such as growth in unemployment or defaults. If I would be wrong here about the sellers’ behavior and market weakening continues beyond the 20% price drop level, that alone could definitely lead to a recession in Canada, if observed on a national-level scale.

For significant and sustained housing affordability improvement a recession is required in my view, plus in addition, there must be a very clear answer to the question “Why the government can’t/won’t support the housing market?”. The answer to this question is the most crucial and challenging because there are a lot of ways and tools available to stabilize the market so sustained and material affordability improvement requires either policy error or an environment where those tools can’t be applied or become ineffective. I don’t know a historical precedent for such an environment, potentially early 90-s would be one but I have very limited knowledge about it to make any conclusions. That topic keeps me up at night.

The 2022 budget is mostly a political paper. I would only keep an eye on the impact of the assignment sales tax.

For those who are hoping to time the market and bet on the significant Toronto Metro price correction, here is some historical data about the depth and duration of such corrections(measured in years). Even though most of the price declines occur during the first years, prices usually reach the bottom only within 5-6 years. Also, make sure your income is bulletproof and can withstand a potential recession.