Toronto Metro Real Estate Market Newsletter (May 2021)

Overview of important developments in the housing market, macro, and financial world reported in May 2021

Unfortunately, I was unable to provide you market update in Apr 2021 so I’ll share a deeper analysis this time.

The leading theme of May 2021 for Toronto Metro Real Estate market was continued slowdown of the resale market.

Before we go into details I’d like you to remember one thing - the market is still very competitive. It is slowing down from a very tight setup and the process is quite gradual.

What makes it interesting that slowdown is not typical for this time of the year so it would be a good idea to restrain from any quick conclusions and just watch where this non-typical slowdown will lead us. It could be nothing more than sales reversion to historical levels, temporary impact of the 3rd wave lockdowns or it could be a fundamental shift like market response to the deteriorating affordability. It’s important to mention that Real Estate market slowdown is not just limited to Toronto Metro but also observed in other places across Canada.

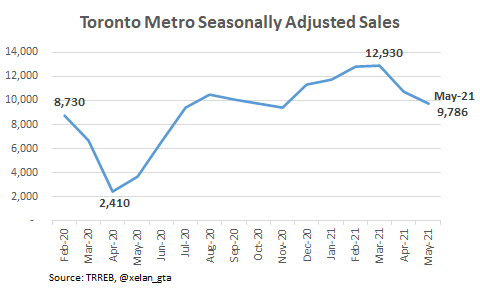

Let’s dive into some stats. The clearest sign of the slowdown is sales decline. While most media is quoting nominal sales stats, those are underestimating the scale of the slowdown. Seasonally adjusted data, while not perfect, is better reflecting today’s reality.

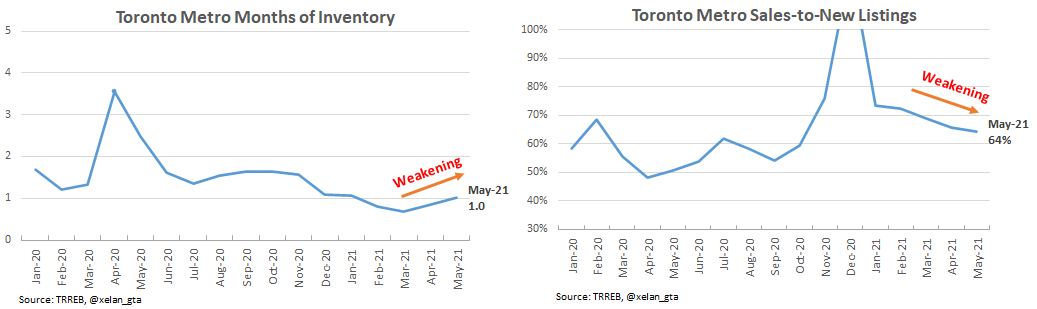

However, sales alone don’t paint the full picture so here are the market balance indicators.

Both are pointing to the market weakening recently. (both are still in the Seller’s market territory).

Prices continue to rise which is expected in a Seller’s market.

Housing Affordability

As a result of rapid price growth affordability continues to deteriorate.

It is worse than 2017 and Toronto Metro real estate market is the most unaffordable since 1991. (Spoiler alert, it will get even worse in the near term)

While affordability remains one of the key vulnerabilities and risks it doesn’t allow to “time the market”. We’ll definitely see more and more pressure put on politicians to address this issue. Meanwhile, exodus from Toronto should accelerate.

Condo vs Single-Family

Since Toronto Metro real estate market is slowing down the logical question is how this weakness is distributed. After a huge run-up in single-family prices, it would be reasonable that condos start to outperform.

I even created a poll on this topic to capture the opinions of my Twitter followers:

That’s exactly what happened in Q1 2021, condos started to gain momentum and market balance indicators for the condo sector became tighter than those for the overall market (and single-family).

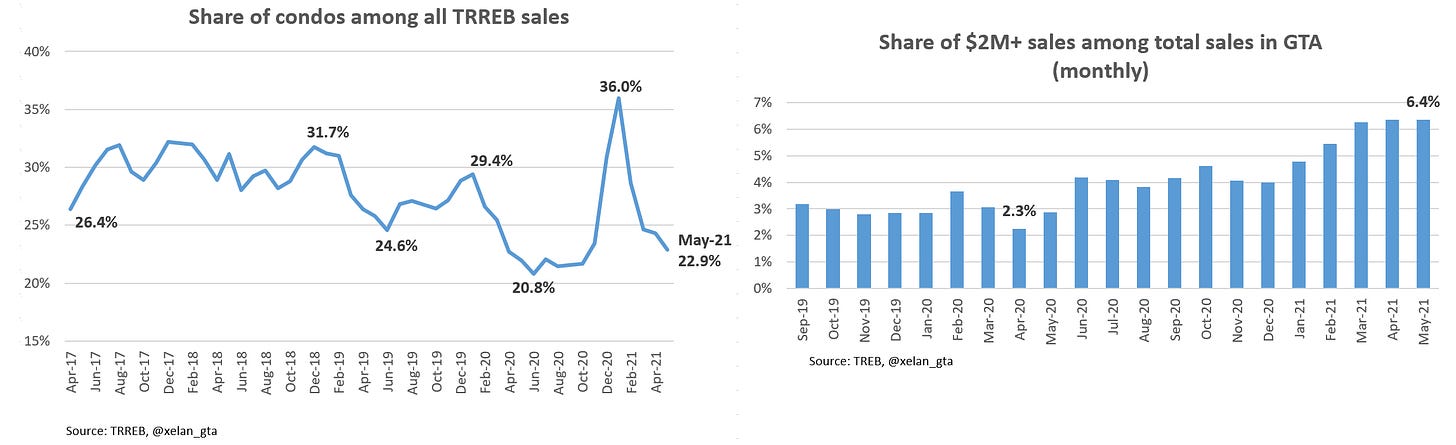

However, surprisingly enough, today condo sector is slowing down faster than the overal market (and single-family).

I can’t tell you for sure why it’s happening but that’s one of the developments definitely worth watching closely.

Risks to the Average Price metric

While prices should grow in a Seller’s market as they do today, the average price is exposed to substantial downside risk.

Two components of the sales composition mix that mathematically affecting average price are significantly outside of the norm:

Share of condos among total sales

Share of luxury ($2M+) sales

Reversal to the mean in any of those metrics (let alone both) will cause the average price to decline. Metrics are correlated to some extent but it’s too big of a rabbit hole to dive into right now.

Luckily there are other metrics such as median price and benchmark price which help to gauge real price movements. Long story short, if you see in the coming months an unexpected decline in the average price compared to other price metrics it will likely be related to the factors discussed here.

Rental Market

Toronto Metro rental market found support in May. The market balance indicator landed in the balanced zone in line with fairly stable 2013-2015 years.

Active rental inventory increased for the first time since November 2020 and started to behave much closer to regular seasonal patterns. Overall total active rental inventory is still about 2x compared to the historical average presenting a headwind for the rental market.

Toronto Metro Average rent price continues to increase however it’s happening in line with the traditional seasonality so it’s not a sign of strength at this point.

The main reason why we are having a balanced rental market with 2x inventory is excessive turnover caused by renters switching units to take advantage of cheaper rent.

Eventually, this demand boost will be gone weakening rental market balance. Another headwind is vacant units. While I don’t have actual data on that topic, high-level data is suggesting that some of the rental units are being removed from the market and kept vacant. Housing analyst Stephen Punwasi seems to have some data supporting that thesis:

Another headwind is construction levels which are elevated. The share of purpose-built rentals is historically high and based on the construction cycle we could see high levels of apartment completions in the near future boosting rental supply.

It would be fair to say that while Toronto Metro rental market stabilized for now, it’s facing a number of material downside risks.

What about upside risks?

The main one, which the market is fully anticipating, is reopening of the borders.

Influx of tourists will bring Airbnb back to life causing some long-term rental units to be transferred back to the short-term rentals pool.

New International Students and those who were previously enrolled online will boost rental demand causing the rental market to tighten.

Landlords, who are currently keeping units empty may continue doing so reducing housing supply and boosting rent prices.

Recovery in the labour market will allow some households with temporary crowded accommodations to start seeking their own housing.

July-Sep 2021 is a very crucial period for Toronto Metro rental market

Timing is crucial for the rental market. International Students normally arrive in July-August. If borders are not reopened by that time or International Students simply prefer not to come to Canada and continue studying online that would be bad news for the rental market and the whole condo investment sentiment.

Downside risks along with traditionally slow seasonality in the rental market may cause rent prices to revisit or even beat the previous lows.

On the other hand, if online learning is terminated, borders are reopened and International Students arrive for in-class learning in September that could potentially significantly tighten the rental market.

I personally don’t have a strong opinion of how the rental market will look like after borders reopening however Ben Rabidoux (via Edge Realty Analytics) seem to be more confident that we won’t see a quick rebound in the rental market.

Condo Investment

Recent data is suggesting that investors are very optimistic to the point that they are not pricing in any possibility for the rental market to weaken, go sideways or recover slowly.

New condo sales are booming while proxy data is suggesting that price premium over resale is quite rich historically.

Estimated cash flow for resale condo purchases deteriorated to the record low levels

With such a high level of optimism, investors need a robust recovery in the rental market so if international students don’t come for in-class learning this fall causing a sluggish performance in the rental market (or worse they come in but the rental market doesn’t tighten) it will be a significant blow to the whole condo investment confidence.

The bond market presents another significant risk for condo investors both from cap rates and cash flow perspectives. The faster and stronger economy rebounds after COVID-19 the sooner long-term bond yields will rise, lifting fixed mortgage rates in the process.

Mortgage stress-test rate increased starting June 1, 2021

As of June 1, 2021, OSFI adjusted the mortgage stress-test rate for uninsured mortgages. The revised calculation of the minimum qualifying rate for uninsured mortgages is: The greater of the contract rate plus 2% or 5.25% (prev 4.79%) (Link)

I don’t expect any material impact as a result of this change. It’s important to remember that OSFI regulates federal financial institutions so the primary goal behind regulations like this is to de-risk financial institutions and push the riskiest loans towards B/private lenders which they don’t care about.

It’s not a “housing cooling” tool, however, it may have some limited cooling impact. OSFI is not protecting homebuyers, it’s protecting the banks and taxpayers.

Conclusions

While Canadian economy is struggling as a result of the ongoing lockdowns Toronto Metro housing market is starting to cool off from very tight levels led by the condo sector. Labor market recovery is sluggish, which is not a surprise, however, government support programs are still active. Mortgage arrears remain stable and low therefore not presenting any risks at the moment.

Rental market was tightening since November 2020 and currently is quite balanced. A number of material downside risks exist therefore it would be important to monitor it in the coming months to see if borders are going to open and international students arrive for September 2021 semester.

UofT seems to be optimistic that international students will arrive this fall.

Meanwhile, Toronto Metro housing market valuations are extreme and housing is the most unaffordable since 1991 today. Condo investment metrics such as cash flow and cap-bond yields spread are historically low signaling extreme optimism by investors. Without quick rental market recovery, investors’ confidence will be tested.

Bond market hit a pause for now and as a result, discounted fixed mortgage rates stayed the same for the last 3 months. In case yields resume upward movement it will cause fixed mortgage rates to rise and worsen housing affordability and real estate investment attractiveness.

Due to extreme uncertainty I simply don’t know how things are going to play out in the next 6-12 months so instead, I’ll just wait for the economy to reopen and monitor its impact on the Toronto Metro housing market.