Buyers Stay on the Sidelines as Risks Rise

Overview of important developments in the Toronto Metro housing market and macro reported in March 2025

Highlights

Toronto Metro sales remained exceptionally low in March

Rents edged up, but Toronto Metro’s rental market continued to weaken

New risks are emerging for the housing market

Population growth is slowing — but is it slowing fast enough?

An important angle on the impact of the population growth slowdown in Ontario and Toronto

Housing affordability and investment appeal are showing signs of improvement

Households face rising financial stress, despite strong wage growth

Real Estate Market

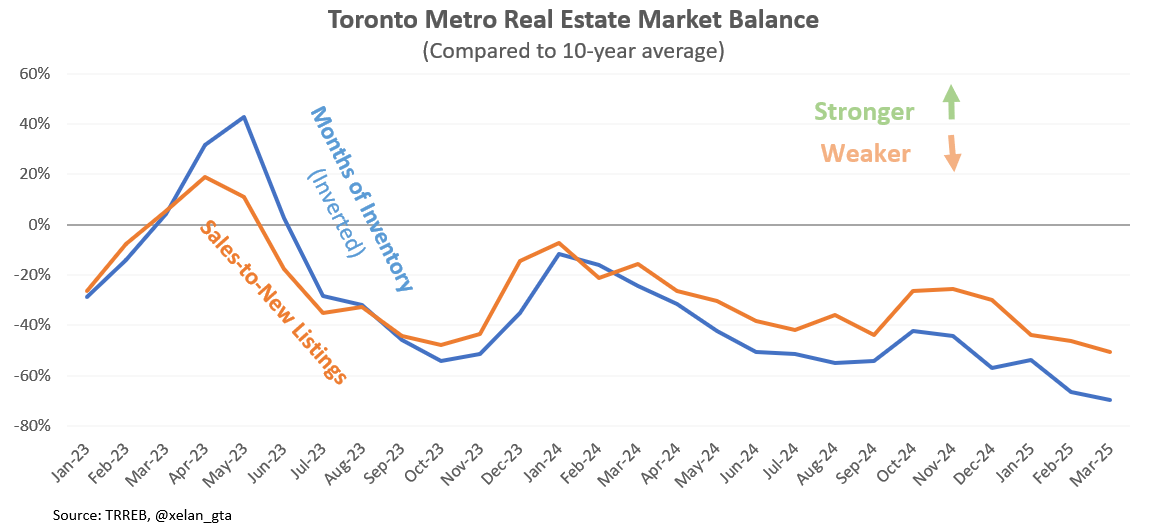

February saw a sharp decline in sales, pushing the market balance to its weakest level in decades. I suggested this could be partly due to harsh weather in the GTA (link). However, sales fell even further in March relative to the 10-year average, reaching the lowest level since 1998. This indicates that other factors, such as growing uncertainty or expectations of further price declines, may be at play.

New listings and active inventory remained relatively stable compared to the 10-year average.

Driven by lower sales, market balance indicators plunged to their weakest levels for this month since the 1990s.

Price metrics present a mixed picture but have remained relatively stable, hovering around 18–22% below peak levels.

Seasonal factors support that stability, but once those factors are excluded, underlying prices continue to gradually decline. This is an important shift in the market, which I flagged in the previous newsletter(link) and is worth paying attention to.

Toronto Metro’s rental market continued to weaken in March, with the market balance indicator falling further below the 10-year average.

While the average rent increased by 3% month-over-month, individual segments did not reflect similar gains.

The rental market weakness remains the main story for Toronto Metro, and I don’t see that changing for now.

New Risks

It’s becoming increasingly clear that the housing market in the Toronto Metro is facing a growing number of risks. The market was already quite weak at the beginning of March, but additional concerns emerged over the course of the month,

Keep reading with a 7-day free trial

Subscribe to Toronto Real Estate Analytics to keep reading this post and get 7 days of free access to the full post archives.