Canada's Population Growth Exploded While Housing Completions in Toronto are Subdued

Overview of important developments in the Toronto Metro housing market and macro reported in December 2022

Resale Market

Toronto Metro real estate market didn’t move much in December. Most of the changes are explained by seasonal patterns and the underlying market balance is stable.

The interesting question is - with the current market stability what should happen to prices? Should they stay flat or gradually decline? So far, the data suggests that the latter should be the case.

All price metrics declined in December compared to the previous month. For Average and Median prices this decline is seasonal however Benchmark Price(the price of a typical home) should be less impacted by seasonality and composition mix, and yet it declined as well.

There is no perfect way to capture the underlying trend in price changes but the best option is to use seasonally adjusted benchmark price. The data reveals that even though the pace of price declines is slowing down it’s still exceeding -1% per month.

So even though market balance indicators are stable during recent months, the level where those indicators stabilized implies that underlying Toronto Metro prices should continue declining unless something changes.

Currently, Toronto Metro prices are about 20-22% down from the peak and 10-11% down compared to last year.

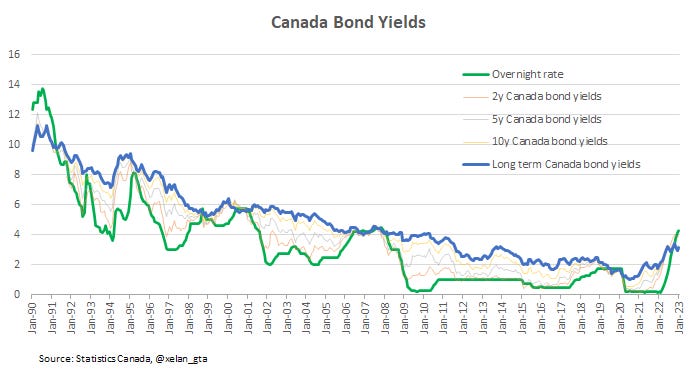

Mortgage Rates

December was the first month since 2020 when the lowest discounted 5-year variable mortgage rate significantly exceeded the fixed one.

This results from the restrictive monetary policy being implemented by the central bankers to control inflation. The scale at which short-term rates exceeded long-term ones hasn’t been seen since the early 90s.

For real estate buyers, it's not very important how high variable mortgage rates will go from here since cheaper alternative options are available.

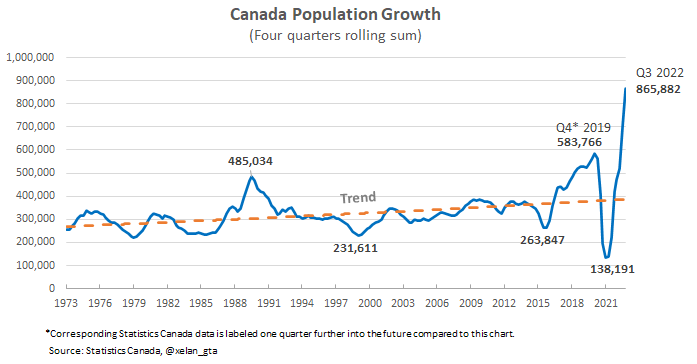

Population Growth

Canada's population growth exploded further in Q3 2022 adding nearly 866,000 people since last year which was in line with my expectations (link).

This increase is 2.25% of the total population - a new record since at least 1973 and a big deviation from the historical average of 1.1%. This deviation is primarily explained by the growth in the non-permanent residents.

Speaking about the immigration component, Canada exceeded the immigration target of 431,645 in 2022, welcoming more than 437,000 new permanent residents. (Source) Compared to the over 372,000 population boost from non-residents the impact of immigration overshoot by about 6,000 is very small.

On a provincial level, for Ontario, it’s important to note that population outflow to other provinces (net Interprovincial migration) is accelerating and is at a record high since at least 1980 both in absolute and also as a percentage of the population. More than 51,000 (net) people left Ontario for other provinces within the year preceding Q4 2022.

Housing Completions

While population growth is setting new records, Toronto Metro housing completions in 2022 are 15% below the 10-year average and also the second lowest during that period.

As a result, demand is exceeding supply and creating pressure on the Toronto Metro housing market, especially the rental one.

New housing starts, however, are running at a much stronger pace, about 40,000 units per year.

With starts exceeding completions, the number of units in the construction pipeline continues to grow, reaching a new record high of nearly 99,000 units.

Since those units are not completed yet, they are unable to provide timely relief to the housing market.

The year 2023 looks more promising for the housing supply. Urbanation Inc. is expecting nearly 32,000 of just condo units to be completed this year (link). Completions for other housing types such as rental apartments, single/semi-detached houses, and townhouses will be added to that number.

To give you a perspective, expected condo completions for 2023 are more than double compared to 2022 completions and 82% above the 10-year average.

Rental Market

Toronto Metro rental market remains tight and stable. Even though the average rent price declined in December due to seasonality, growth is expected to resume in spring unless the balance changes.

Market balance indicator - Months of Inventory is still low, in line with the years when strong rent price growth was experienced.

The only caveat is that rent prices are already quite unaffordable which may limit further rent price growth despite the tight market balance.

Conclusions

Toronto Metro real estate market is pretty stable, however, it stabilized in the buyer’s market zone which means prices are expected to continue gradually declining unless something changes. Currently, prices are about 20-22% down from the peak and 10-11% down compared to last year.

As a result of interest rate tightening variable mortgage rates materially exceeded fixed ones for the first time since the beginning of the pandemic. It’s raising risks for existing property owners with variable mortgages but new buyers are likely to prefer fixed options which are looking more attractive now. My focus is also on the lowest available mortgage rates, which is now shifted to the fixed ones. The lowest discounted 5-year fixed rate declined slightly to 4.54% in December.

Housing affordability and investment attractiveness are improving a little but remain near record lows, nothing is materially changing here. Either prices or mortgage rates need to decline significantly(or both) to bring those metrics back closer to historical levels.

Population growth in Canada continues to explode setting a new year-over-year record of nearly 866,000. As a percentage of the total population, this is double compared to the historical average population growth. Such a large deviation from the historical trend is primarily caused by the growth in non-permanent residents.

At the same time, Toronto Metro housing completions are 15% below the 10-year average, falling short behind the starts and boosting the number of units in the construction pipeline to nearly 99,000.

Strong population growth with low housing completions created significant stress for the Toronto Metro rental market causing rent prices to grow by 11% within a year. The rental market balance remains tight but high rent prices may limit further increases.

Some relief from the supply side in Toronto Metro could be seen in 2023 since Urbanation is expecting nearly 32,000 condo units completed in 2023, which would be more than double compared to 2022 condo completions and 82% above the 10-year average. As it’s the case with any forecast it should be taken with a grain of salt.