Population Growth: Is Canada Biting More Than it Can Chew?

Overview of important developments in the Toronto Metro housing market and macro reported in March 2023

Before focusing on the main topic of population growth I’ll start with a brief overview of the latest development in the Toronto Metro real estate market.

Resale Market

Toronto Metro resale market continued to tighten in March. Both market balance indicators became stronger.

While it appears that sellers are mainly responsible for the tightening of the Toronto Metro real estate market, there has also been a slight increase in buying activity beyond the typical seasonal rise.

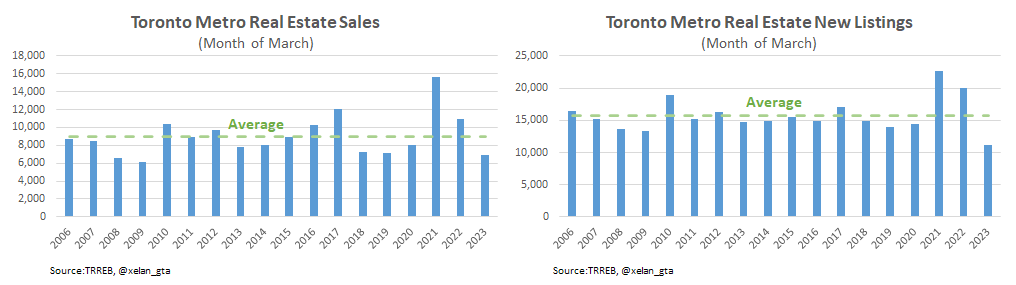

Both sales and new listings remain historically low, however, a decline in new listings is the biggest since at least 2006 so low new listings remain a bigger story here.

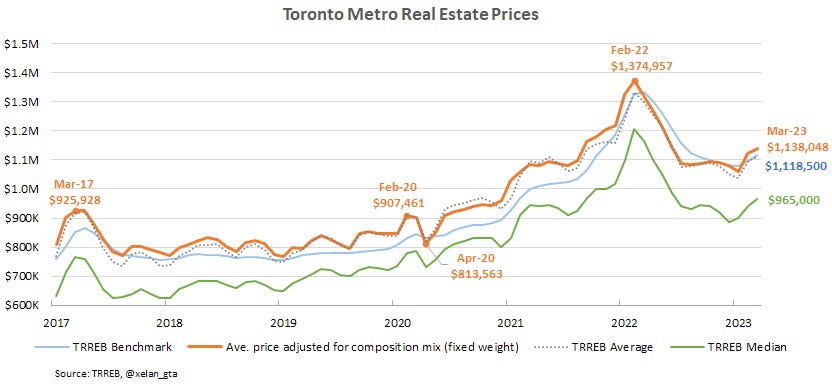

As a result of the tight market, prices continue to increase.

Mortgage rates have remained relatively stable, and so did housing affordability and real estate investment attractiveness. It's important to note that a rebound in prices would further worsen these metrics, assuming other factors remain unchanged.

Recently, I've been asked whether now is a good time to purchase property in the Greater Toronto Area (GTA). While it's impossible to predict the future, GTA's real estate market is historically the most unaffordable since at least the mid-80s. Therefore, to me, personally, it doesn’t look like a medium/long-term buying opportunity, but a short-term flip may work. I was wrong in the past and I could be wrong again so don’t rely on my views. If you are a buyer today, you may want to check the condo assignment market.

Rental Market

The Toronto Metro Rental market continues to tighten faster than it usually does during this time of the year.

Surprisingly, rent prices have shown a slight decline in this situation.

This could be due to a change in the composition of rental properties or the fact that rent prices are already very high and unaffordable. Future data should help clarify the picture, but given the current market conditions, we should typically expect rent prices to increase.

Population growth

Canada's population growth remains one of the key trends to watch. In 2022 the growth rate was 2.7%, which is equivalent to 1,040,110 people. This is more than twice the average historical rate and also the immigration target of 431,645.

Such a big deviation from the immigration target is attributed to the record-breaking surge in non-permanent residents, which surpassed 600,000 and exceeded any previous peak since at least 1973 by more than 3x.

I highlighted this emerging trend as early as May 2022 (link):

Inputs into population growth such as immigration and new study permits started 2022 on a very strong note. A record amount of new study permits were issued during the first two months.

and have been monitoring it since then. However, I couldn't have foreseen a year ago that the net increase would surpass 600,000, which is an astounding number. To put this in perspective, accommodating 600,000 individuals would require, for example, constructing about 300 ninety-five-storey skyscrapers similar to the one below. In terms of demand for infrastructure and services, it would be comparable to adding a city like Brampton.

During the time when we have housing shortages in Canada unexpected population growth of that magnitude undoubtedly causes the tightening of the real estate markets, especially rental ones.

To further show how extraordinary this number is, the increase in non-permanent residents in 2022 alone surpassed the cumulative growth projected by the Canadian Government for the next two decades under all medium growth scenarios.

Who are the non-permanent residents, and what caused the surge in their numbers in 2022? The group includes international students and their spouses, temporary workers, and refugees, with a majority being connected to international students. All those categories experienced growth in 2022.

Canada's immigration system increasingly prefers international students with Canadian education and work experience to fill in immigration quotas, which explains the growth in the number of non-permanent residents in recent years. Although this trend slowed down during the pandemic, it strongly rebounded in 2022, with the total number of international students in Canada increased by 30% in just one year.

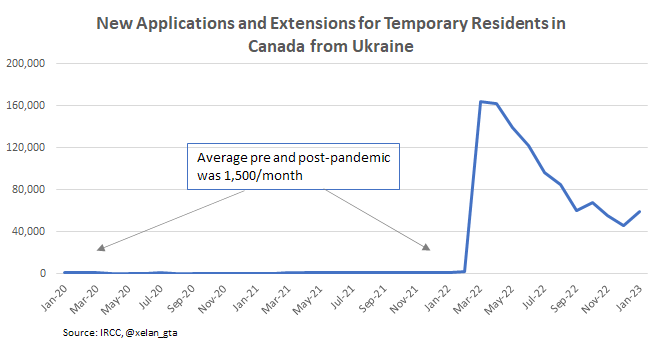

In 2022, the war in Ukraine was a new significant contributing factor boosting the number of non-permanent residents. Canada introduced the CUAET program (link), which enabled all Ukrainians to obtain Temporary Resident status in Canada and also to study or work. The impact of this program is significant, with almost 1,000,000 Ukrainians (and counting) applying for it. Out of these applicants, 644,000 were approved, and 147,000 arrived in Canada (link). Since only a small portion of the applicants have arrived, and also due to delays in application processing, there is a lot of potential for further arrivals.

A leading indicator is suggesting that a lot of new applications for temporary residence from Ukrainians continue to be submitted every month.

So this population growth tailwind is expected to continue with more Ukrainians arriving in 2023 under CUAET. In fact, January data (the latest) for all international inputs into Canada’s population growth was record high.

The estimate for the working-age population in Canada from LFS shows a record month-over-month increase in March and the whole of Q1 2023.

The data is pointing to a real possibility of a new record in annual population growth in Canada ahead, exceeding the current one of 1,050,110.

Population growth is beneficial for the housing market, but there is a caveat. A modest increase in non-permanent residents is typically not a concern, but the growth we saw in 2022 poses a risk of outflows in the future, and here's why.

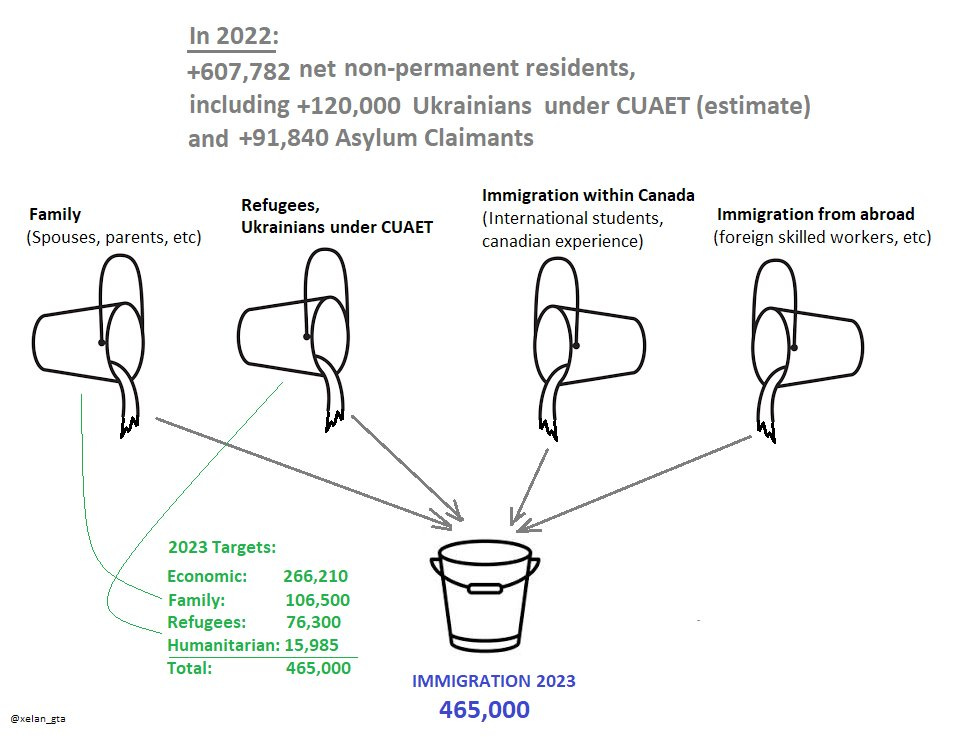

Each non-permanent resident in Canada has an expiration date on their status, and the majority of them fall under the international student-related categories with the goal of obtaining permanent residency in Canada. That's where the risk exists. The only way to obtain permanent residency is through the immigration process, and quotas for immigration are limited and defined in advance. Here is the picture I created to demonstrate this point.

Economic immigration is divided between applicants within Canada and those abroad, so with a modest increase in non-permanent residents, a larger share of economic immigration can be given to those within Canada. However, with an increase of 600,000, there aren't enough spots available for everyone based on the current immigration targets. Boosting the immigration targets to the top of the range will provide additional spaces but it still likely not going to be enough if high rates of non-permanent resident admissions continue.

The risk we are facing is that the record inflows of non-permanent residents today may turn into record outflows in the future.

The options to avoid it would be:

Extending the duration of the temporary residence permits. In fact, Canada is already resorting to that option and extending Post-Gratudate Work Permits(PGWP) (link). This is not the first time such an extension has been implemented, there was another one prior to that (link). Fundamentally extensions don’t resolve the issue but allow to “kick the can down the road”. They also indicate existing bottlenecks in the process of transitioning temporary residents to permanent status. Meanwhile, the number of PGWP holders is expected to increase, and they will now face competition from Ukrainians under CUAET for permanent residency.

Increasing immigration targets. This is the only way to convert more temporary residents into permanent residents. However, immigration targets must be set well in advance to allow municipalities to accommodate the growth. Immigration targets for 2023-2025 have already been established but can be adjusted if necessary.

A significant increase in immigration targets could be challenging since there is already a legitimate growing concern that housing and infrastructure are not ready for such high levels of population growth. One of the examples would be National Bank which noted in their recent research (link):

“Ottawa should consider revising its immigration targets to allow supply to catch up with demand” - National Bank Financial

While I agree with the view that unlimited admission of non-permanent residents and lack of proper planning are policy mistakes, due to the risk of non-permanent residents’ outflow I would speculate that we are going to see an increase in immigration targets, potentially quite significant. Also, I’m expecting it to happen regardless of the labour market strength.

Conclusions

The real estate market in Toronto Metro continued to tighten in March due to a decline in new listings and a slight increase in sales. Financial fundamentals such as Housing affordability and real estate investment attractiveness remained near the worst levels since at least the mid-80s, and while the rental market is tightening, rent prices are holding steady for now.

Population growth data remains in the spotlight. The latest data revealed that in 2022 Canada's population grew by more than 1,000,000 with over 600,000 of that growth coming unexpectedly from non-permanent residents group where no planning or quotas exist. The growth was mostly from international students and Ukrainians under the CUAET program, and this trend is expected to continue in 2023, potentially leading to new population growth records.

The magnitude of the growth in non-permanent residents is unprecedented, as it is more than three times higher than anything seen since 1973, so it is not surprising that real estate markets are tightening as a result.

It raises the question if Canada is biting more than it can chew. There is a legitimate concern about whether Canada has the necessary housing and infrastructure to accommodate such a high level of population growth. Additionally, it’s not clear how Canada is going to transition so many non-permanent residents to permanent ones since it can only be done through immigration where quotas are predefined.

To address this issue, a combination of steps could be taken, such as extending non-permanent resident permits, increasing immigration targets to the top of the predefined ranges, or revising both immigration targets and ranges. However, due to the growing concerns about the lack of infrastructure and deteriorating rental affordability, those changes may not be widely supported by the public. On the other hand, failure to take these steps could result in an outflow of non-permanent residents who are unable to obtain permanent resident status before their permits expire. It is important to note that this risk exists even while the Canadian labour market is strong, and it will be magnified if it weakens significantly.