The Market Continues to Tighten in a Unique Way

Overview of important developments in the Toronto Metro housing market and macro reported in April 2023

The Toronto Metro real estate market in April showed further tightening, reflected in market balance indicators,

which in addition to seasonality, has led to an increase in prices.

Month-over-Month change in Seasonally Adjusted Home Price Index(HPI) jumped to 2.4%, which is nearly 29% annual price growth rate.

It is expected that prices will continue to rise in the near future. However, the current market differs significantly from anything observed since at least 2006. When considering the overall activity, which includes both sales and new listings on a seasonally adjusted basis, the most recent figures are historically low primarily due to a persistent decline in new listings.

New construction sales remain subdued, indicating a low number of new housing starts in the near future.

Despite politicians' promises to address the housing supply shortages, market forces continue to be the main driver of new construction. Toronto chief planner recently acknowledged this fact, and we can clearly see impact of the market forces in action right now.

I don’t want to take away all responsibilities from the city for housing crisis. The city can definitely help by cutting red tape, lowering development chargers, relyling less on NIMBYs, increase staffing, etc. My goal here to draw attention to market forces which are critical and are often overlooked in political speeches and housing supply promises. Simply put, if no condos will be pre-sold, no condos will be built.

Interest Rates and Financial Wellbeing of Households

After a significant and swift rise, interest rates seem to have reached their peak. The Bank of Canada has implemented a cumulative 4.25% tightening, while the Fed has raised its policy rate by 5.00%. The markets are currently anticipating rate cuts as the next move, which suggests that this may be the peak for this cycle.

When adjusted for debt levels it was the most restrictive and swiftest tightening cycle since at least the 90s.

It may seem confusing why there are so few new listings despite such a significant increase in interest rates. The explanation lies in the financial wellbeing of property owners, which I covered in Nov 2022 (link). I found no indications of immediate financial distress among households, which is necessary for a significant and sustained market correction. In the current environment it is beneficial for sellers to "wait it out," and that is precisely what they are doing.

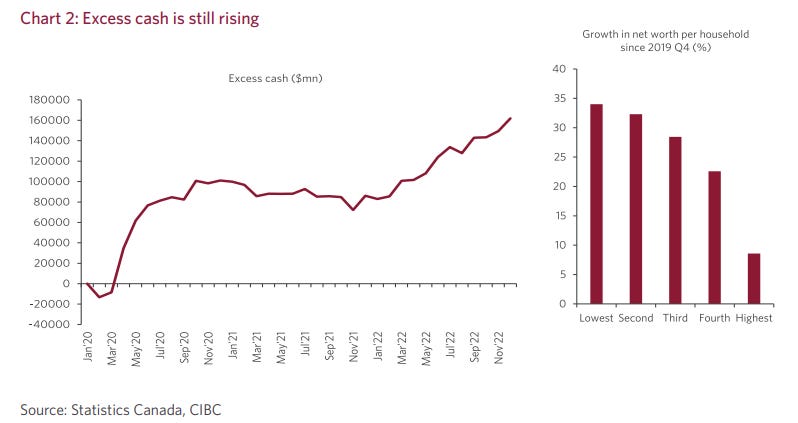

CIBC recently conducted research on this topic, providing valuable insights into the financial well-being of Canadian households (link).

They concluded:

“Overall, consumers entered this tightening cycle in excellent financial shape, and are still in a strong position due to large amounts of excess cash and a strong labour market” - CIBC

Despite a cumulative 4.25% increase in interest rates households are doing well today thanks to:

Work-from-home related savings

Accumulated excess cash

Paid off high-interest debt during the pandemic

Strong labour market

The delayed impact of interest rate increases (Full impact typically occurs in 12-18 months)

Variable mortgages with fixed payments (VRM) are generally don’t experience payments increase until renewal.

Although total mortgage payments for the most borrowers have not changed significantly, the interest portion is increasing rapidly, and this trend will continue as fixed mortgage holders continue to renew their mortgages.

While there are absolutely valid concerns about potential future financial stress related to mortgage payment shocks during renewals,

depleted savings, rising unemployment, negative cash flow in the pre-construction closings, and other factors, that stress is not present today. Therefore, it is evident why the Toronto Metro real estate market behaves the way it is.

Rental Market

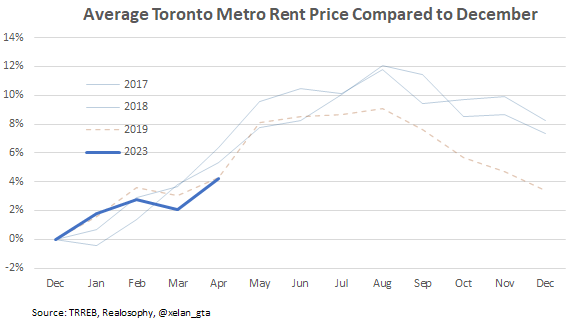

The rental market remains tight but stable, with rent prices increasing by 10.5% in April compared to the previous year, driven by seasonality and market tightness.

However, most of the increase occurred in 2022, and here is how performance in 2023 looks like compared to the period of 2017-2019, where the market was similarly tight.

While it is reasonable to expect that rent prices will continue to increase, it is uncertain how strong this growth is going to be. In 2017 and 2018, rent prices rose by approximately 8%, but in 2019, when rental affordability was as poor as it is today, the growth was only 3%.

Housing Completions and Population Growth

Analytics from Urbanation released earlier this year set expectations for an elevated number of Toronto Metro housing units completed in 2023 and we are starting to finally see confirmation in the data. The combined number of units completed in the February and March 2023 is the 3rd highest in the past 11 years.

However, it’s not expected to bring noticeable relief. Canada's population is rapidly increasing and international inputs remain record high so it’s reasonable to expect new population growth records ahead.

When population growth exceeds the immigration target by more than double, a slight uptick in housing completions is a drop in the bucket. Given that explosive population growth, rent prices in Toronto Metro are holding up exceptionally well in 2023, likely because they are already very unaffordable.

The impact of population growth on the labour market has been a focus of the Bank of Canada's deliberations. It is an area of great interest to me because it challenges the mainstream linear view that higher immigration helps to balance a tight labour market. Instead, the relationship is more complex, as new immigrants not only fill existing vacancies but also contribute to demand, creating new vacancies.

Conclusions

Toronto Metro real estate market continued to tighten in April, with some real estate agents starting to report signs of FOMO (Fear Of Missing Out).

No doubt, Toronto is a seller's market today but it’s nowhere near the tightness observed during 2017 or 2021-2022. Insights from real estate agents are leading indicators so the market we will likely continue to tighten in May. To give you an example of how non-FOMO April data is, on average all GTA condos were sold at the asking prices (Sold Price / List Price of 100% as reported by TRREB).

Today’s market is unique because it’s tight but at the same time, overall activity is historically low. There are no booming sales, in fact, depending on how seasonal adjustment is done sales may even be declining. The lack of new listings is keeping the market tight, and sellers are in full control.

Tight market, declining new construction activity, expectation of lower rates in the future and strong population growth make delaying the sale of property a winning strategy for sellers. Sellers are able to execute it because they are not stressed financially. A study performed by CIBC provides deep insights into this topic.

Although households' financials may be fine today, it's important to consider how they achieved this. Analysis of these means reveals significant risks ahead. Therefore, it's impossible to conclude whether the worst for the Toronto Metro real estate market is behind us or not. Defaults and unemployment are likely to increase in the future, and the probability of a recession is high. Key metrics such as housing affordability and investment attractiveness remain near historical lows.

However, if these risks don't fully materialize, with government support, population growth, and low new construction activity, a case can be made for a new stretch of a bull/stable market. That is how TD sees it, forecasting the market bottom in Q2 (link), however, I remain cautious and, in my view, risks are tilted to the downside.

Meanwhile, time is working against buyers in the Toronto Metro real estate market.