There is a 2016-Like Feel in the Air

Overview of important developments in the Toronto Metro housing market and macro reported in September 2021.

Toronto Metro real estate market was very puzzling in recent months. Sales were declining and prices weren’t really moving anywhere so it seemed that the market was cooling off, at the same time market balance remained very tight, and active inventory was at a 15+-year record low (for those months).

I provided some possible explanations for that discrepancy in my June newsletter (link) and was leaning towards trusting market balance indicators.

“Last month my short-term outlook for Toronto Metro was quite bullish and it became even more bullish in July in spite of slowing down sales and declining average price.” (link)

September data shuttered all the remaining slowdown suspicions. All price metrics rebounded strongly and even though there was an increase in the share of luxury sales affecting average and median prices, benchmark price is designed to account for that and it also increased significantly in September. It was a genuinely strong market move.

Flat benchmark price1 in recent months was explained mainly by seasonality and methodology but it’s too big(and boring) of a rabbit hole to go down.

Now, when there is no doubt left that Toronto Metro market is strong, the time has come to voice a concern that it definitely has a 2016-like feel to it. 2016 was a very strong year for Toronto Metro real estate market with a rapid price acceleration leading into 2017 which followed by a correction. Here are a number of metrics to back up that statement.

However, there are very distinct differences as well.

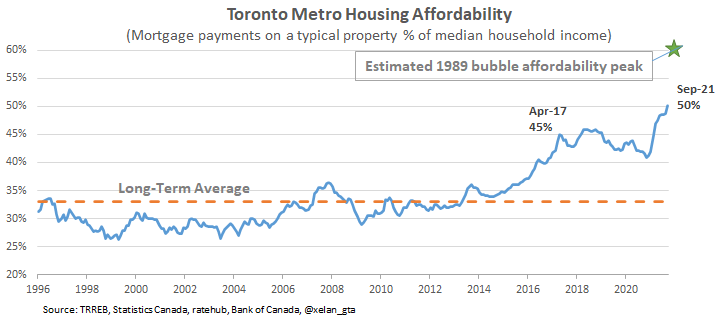

[This is the most important one] Housing affordability is much worse today compared to 2016-2017.

Price appreciation today is led by the single-family segment to a much lesser degree compared to 2016-2017

Market tightness today is primarily caused by the lack of supply vs strong demand(sales) in 2016-2017. (there was a strong demand in the early 2021)

Mortgage rates were declining in 2016 bottoming in 2017, today it seems that the bottom for mortgage rates already happened.

To sum it up, while there are many similarities, those two periods are not the same. Don’t project any 2016-2017 historical data into the future performance of the GTA real estate market.

In the near term, Toronto Metro resale market is likely to be strong and right now I see no signs of a slowdown.

Housing affordability is the worst in 30 years

The rapid price increase in September caused housing affordability2 to deteriorate further. This is a major risk for Toronto Metro real estate market which will remain on the radar. The further affordability moves above the historical average - the bigger the risk of a price correction.

While the near-term outlook is positive, the market remains very unaffordable suggesting a high level of overvaluation.

Among other findings, housing sales slightly increased in September compared to the last month on a seasonally adjusted basis. Condo sector remains weaker than single-family and as a result price gap between those two is widening.

Rental Market

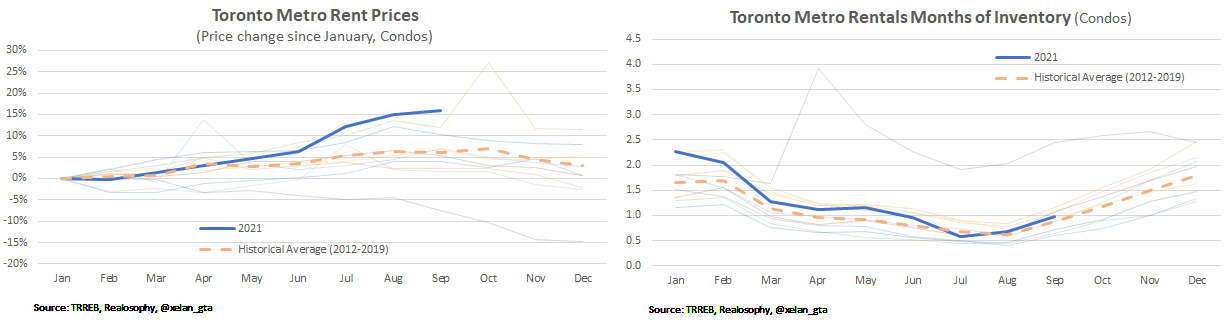

Toronto Metro rental market weakened in September as it was expected due to seasonality. The estimated number of leases declined substantially from July’s peak.

For actual Toronto Condo rental statistics please see the thread by Ivan Gorbadei (link)

Rental market balance3 is very closely following historical average.

This data is not suggesting any rebound in rent prices. In spite of that, we do see quite a strong rebound.

Average rent price was following seasonal pattern through the most of 2021 but condo sector significantly deviated from it since July.

There is no simple explanation for this phenomenon. I spent some time digging into it and partially it’s explained by the change of leased units composition mix but there is something else to it.

In my view most likely explanations are:

There was a lot of buzz about international students arrivals and the rental market rebound so people were much more willing to accept higher rents out of fear those are going to be even higher in the future and also given the fact that rents are still below 2019 peak.

TRREB (source of rental data) is just a subset of rental market so if there was an abnormally strong demand spike for non-TRREB listed units it would affect broad rent prices without being captured in TRREB leasing activity.

September rents increase was much closer to seasonal pattern and rental market balance is weakening since July so we should expect rent prices to plateau or even start declining in the coming months. Any new headlines focused on Toronto Metro rents rebound is “old news” in my view.

Toronto Metro rental active inventory is already significantly above the historical norm and it’s very unlikely to decline in 2021 (unless units are de-listed by landlords).

Elevated inventory is a risk which could lead to the Toronto Metro rental market weakening.

Mortgage Rates

Discounted 5-year fixed mortgage rates increased by 0.11%(to 1.79%) for the first time since April 2021 while discounted 5-year variable rates remained at the record low of 0.98%.

Rising bond yields are bringing again to the spotlight the risk of fixed mortgage rates increase.

Population growth

Population growth was one of the key statistics published in September. Latest available data for Q2 2021 confirmed anecdotes that people are leaving GTA and showed the highest number of people leaving Ontario for other provinces since at least 2000. At the same time BC was facing the highest population inflow from other provinces since at least 2000 which raises a question if outflow from Ontario is really caused by the housing affordability or there are other drivers in play.

I don’t have an answer to why those two trends are happening at the same time but I can share an interesting data point which may or may not be related to it (pure speculation).

Even though Vancouver is more expensive than Toronto, the price premium is shrinking in recent years, falling below 10% (multi-year low) in September.

In simple words, if you were dreaming about selling your GTA property and moving to Vancouver - today is the best(cheapest) time to do that in recent years.

The most important takeaway from the population growth data for me was that 2021 will likely be another year with population growth in Canada significantly below the 2019 peak.

It’s kind of expected intuitively but important to have a confirmation from the official statistics. The data tells us that cumulative Q1+Q2 population growth doesn’t look impressive compared to 2016-2019 years.

While the immigration component picked up strongly in June 2021 it requires absolutely enormous growth for the remainder of the year in order to reach the immigration target of 401k which seems unlikely to me.

If the rental market is any guide then in Q3 net non-permanent residents (mainly students) inflow wasn’t strong and that’s a very crucial component for the whole 2021 population growth.

Time will tell, it’s extremely difficult to forecast the final year-end numbers so we’ll have to wait another 3 months for the next official statistics update.

Population growth data is very important. Weak 2021 population growth coupled with population outflow from Ontario to other provinces can significantly impact Toronto Metro housing supply/demand balance.

Unlike population growth, GTA construction industry never really slowed down during the pandemic and it’s delivering a high amount of units(record by some measures), reducing existing housing shortages.

This development doesn’t look supportive for the rental market which will be a very important indicator to watch for the signs of housing shortages or excess.

Summary

Toronto Metro resale market is on fire, market balance is very tight and prices are accelerating. While short-term outlook remains positive there are glaring risks in plain sight. One of those is housing affordability, which is already very bad and deteriorating further slowly approaching 1989 bubble peak. Lack of new listings which is keeping the market tight is likely a temporary phenomenon. Discounted 5-year mortgage rates are already higher today compared to a year ago which means the share of price growth explained by fundamentals is shrinking. In fact, today the share of year-over-year benchmark price growth not explained by fundamentals is at record high since at least 1997(exceeding 2016-1017 peak) and most certainly will grow even more in the near term.

Toronto Metro rental market rebounded very strongly based on the average rent price, however rent price increase after June is not fully supported by the market balance. Additionally Toronto Metro rental market is facing a number of material risks:

Active rental inventory remains much higher than historical average;

Weak population growth and strong housing completions are leading to weakening of the rental market;

There is an anectodal trend which could partially explain lack of resale listings: people don’t sell houses anymore, they pull equity to purchase a new property and leave the old one as rental. This trend is transferring supply from resale to rental pool tightening the former one and weakening the later;

Termination of the COVID-related government financial support programs may potentially lead to increase in new rental listings;

Rising bond yields caused discounted 5-year mortgage rate to increse a little on Oct 1 and also boosted possibility of further upward move in fixed mortgage rates.

Population growth data doesn’t look strong in 2021 so far(as of Q2 2021), which is understandable. It is possible that the strong population growth rebound which was expected in 2021 will be moved to 2022, however it’s also possible that we won’t reach 2019 population growth peak of 583k for a some time. While it’s not really felt in any metrics except for rental market inventory, housing shortages are being reduced in the GTA for the 2nd year in a row. Unfortunately it’s impossible for me to say how far we are in this process.

Housing Affordability is defined as the share of median household income required to be spent on mortgage payments when buying a typical property. The higher the value - the more unaffordable the market is for homebuyers.

Months of Inventory shows how many months are required to absorb current active inventory at a current level of monthly sales. The lower the value, the stronger the market.

Sales-to-New Listings measures market balance by comparing the number of sales within the last month to the number of new listings during the same period. The higher the value, the stronger the market.