The Toronto Real Estate Market Continued to Slow Down, but Will it Bring Relief?

Overview of important developments in the housing market and macro reported in June 2021

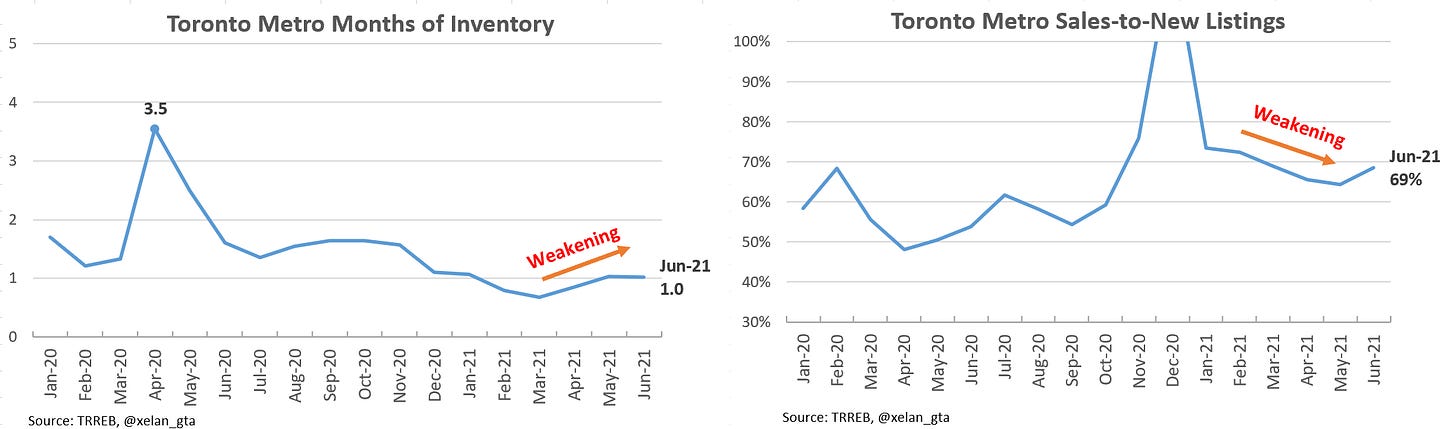

Toronto Metro Real Estate market continued to weaken in June but not everywhere and some signs are starting to emerge regarding where that slowdown could lead us.

Sales continued to descend, declining by about 30% from the peak on a seasonally adjusted basis.

Benchmark Price1 appears to be peaking and both average and median prices even declined compared to the previous month (more on that later).

It may seem that relief for homebuyers is almost here but unfortunately, market balance indicators are still very tight.

What interesting is that in spite of sales decline the market balance is not really changing much and the reason for that is sellers, who are also not eager to list their properties.

Where does that leave us today? Sales have already declined close to historical levels but active listings for the month of June are actually the lowest in at least the last 15 years.

Market is very tight with only 1 month of available inventory2 and market balance indicators didn’t weaken in June.

Toronto Metro prices should NOT decline or even stabilize when market balance indicators are that tight and yet they seem to be stabilizing for now.

Should we trust market balance or price metrics?

This is a very interesting question and there are three possibilities in my view:

Market balance indicators are sending correct signal, which was historically the case. If that’s true, prices should return to an upward trajectory shortly.

Price metrics are sending correct signal indicating that affordability challenges are limiting what buyers are able or willing to pay regardless of how tight the market is.

This is somewhat of a tinfoil theory because market balance indicators have a 15+ years proven track record. However, housing affordability is the worst since 1991 and it’s something that can absolutely impact the market in a major way.

The methodology used in the calculation of TRREB Benchmark Price is very complex and it’s possible that during the previous booming months price growth was overestimated by the benchmark model. The model is now underreporting price growth to compensate for that.

It sounds like a far-fetched take however I do have my own models which indicate that we should be seeing about 15-16% YoY benchmark price growth while it’s currently at 22%. Several “flat” months will bring the benchmark price in line with my models but it’s going to be still about 18% year-over-year price growth if the market balance doesn’t change.

Existing flat month-over-month benchmark price growth also doesn’t fit well with the Sold-over-Asking chart.

The latest reading is still significantly above the historical norm suggesting that the prices are actually growing across the board today.

Option 1 and 3 are more likely in my view and, as a researcher, I would be happy to see option 3 to play out, confirming the accuracy of my models.

In the coming several months, we should get a pretty good idea of which option is correct.

Can sales slowdown result in a balanced market?

If we expect the current slowdown to lead us to a balanced market, taking into account the current level of active inventory, sales need to decline by another 60%. Since sales are already near historical levels it doesn’t sound like they can naturally decline by that much.

We need a material increase in new listings and I don’t see anything pointing to it at the moment.

Therefore it doesn’t seem that the current sales slowdown can realistically bring us to a balanced market, let alone a buyer’s one so we should wait for an uptick in the new listings before we can discuss a possibility of a price correction.

The lowest active inventory for the month of June in at least 15 years is absolutely one of the most important takeaways from TRREB June’s report.

Condo Sector

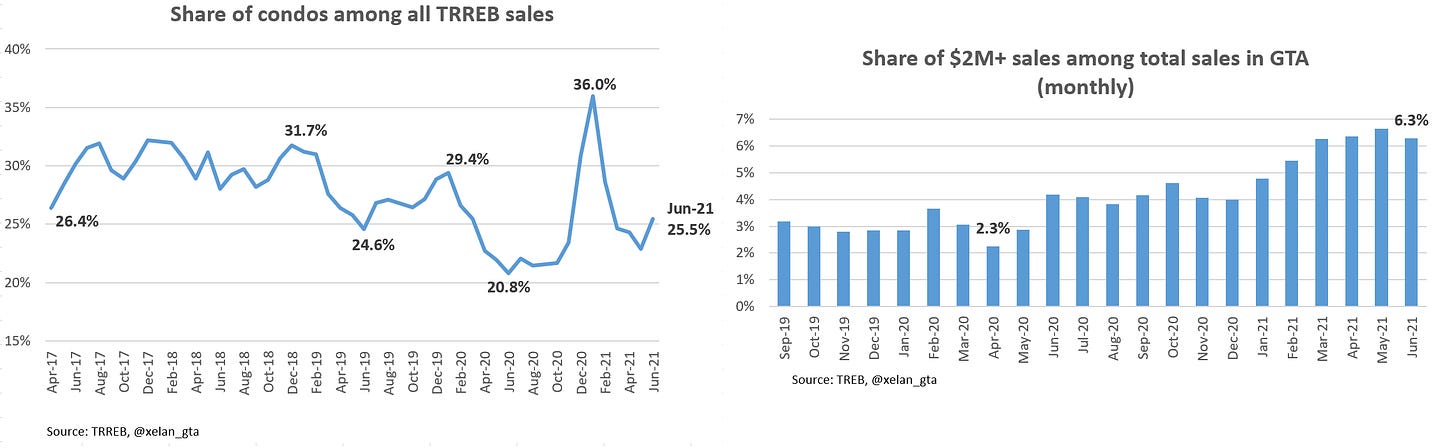

In my May 2021 newsletter(link) I drew your attention to the Toronto Metro condo sector which was weakening faster than the overall market.

That process hit a pause in June. Condo sector is still weaker than the rest of the market but it’s not really weakening anymore.

It’s too early to draw conclusions based just on one month's worth of data but concern about rising condo resale inventory definitely eased.

Why did Toronto Metro average price decline in June?

In my May 2021 newsletter (link) I flagged the risk that average price may decline due to reversal in luxury sales and/or increase in the share of condo sales.

Reversal to the mean in any of those metrics (let alone both) will cause the average price to decline.

Both of those events happened in June and caused the average price to decline by 1.7% compared to the previous month.

There is still a potential left for further reversion of both of those metrics to the mean.

A decline in the average price due to the composition mix change doesn’t mean that the price of any given property is actually going down.

What about the rental market?

Rental market showed some strength in June. Rent prices are growing since Jan 2021 but so far it was in line with the seasonal trends. In June Toronto Metro rent prices increased a little faster with average rent reaching $2,409/month. (Prev. 2,387/month)

Rental market strength is not led by the condo sector. Market balance indicator for condos is closely following readings for very stable 2014-2015 years.

This is not a “rebound” pattern, at least for now. The big difference between 2021 and 2014-2015 is that today both volume of leases and the number of active listings are about 2x higher.

In the coming months, I’ll be closely watching rental market inventory to get a clue about international students arrivals. (More about upside & downside risks were highlighted in my May 2021 newsletter. Link)

Mortgage rates

Fixed mortgage rates are dependant on Canada 5-year Bond Yields which stabilized in the recent months after a meteoric rise in Q1 2021.

Some investors are starting to believe that global recovery is slowing down and if they are correct bond yields should decline, bringing fixed mortgage rates down with them.

I don’t really have a short-term view on the bond yields but in general, we are in a recovery mode and the economy is going to continue to rebound until the labor market becomes tight and rate hikes are necessary (Expected in 2022-2023 currently).

Variable mortgage rate, on the other hand, depends on the Bank of Canada’s rate and recently it declined to the historically record low rate of 0.98% (prev. 1.10%)

That’s not a lot but still provides about 1.4% of purchasing power.

Conclusions

To sum it all up, in spite of the sales slowdown the current setup for the Toronto Metro real estate market looks positive in the short term.

New listings are plummeting together with sales and current active resale inventory for the month of June is the lowest in at least the last 15 years.

The rental market is stable and strengthening a bit. With the real possibility of international students arrivals, it seems that upside risks prevail at the moment.

International Immigration reopening will create additional demand for housing.

High vaccination rates, excessive households savings, and lockdowns easing are supporting further rebound of the Canadian economy.

Variable mortgage rates just hit a record low of 0.98% and there is a possibility for fixed mortgage rates to decline as well.

Upcoming federal election reduces the chances of any material housing cooling measures.

Downside risks exist as well and there is always a chance of unexpected events so nothing is set in stone.

Two important questions remain:

Why the growth in Toronto Metro Benchmark Price is slowing down that much in spite of the very tight market?

How many International Students are going to arrive for Sep 2021 term?

Future data should provide answers to those questions.

Months of Inventory shows how many months are required to absorb current active inventory at a current level of monthly sales. The lower the value, the stronger the market.