An Increase in New Listings has Finally Arrived

Overview of important developments in the Toronto Metro housing market and macro reported in May 2023

In the previous month, I drew attention to the unusually low level of overall activity observed in the Toronto Metro market (link). However, things took a turn in May, with significant shifts occurring in the market. The most notable one was an uptick in new listings which increased by 34% compared to April.

It was also the first increase in 2023 when adjusted for seasonality. This development led to a growth in active inventory which I pointed out on Twitter.

Furthermore, it also halted the tightening of the market, as indicated by contradictory signals observed in the recent movements of market balance indicators.

Addressing the question I posed in my Twitter post, the rise in active inventory was accompanied by an increase in sales, allowing the market balance to remain relatively stable. While stabilization is positive news, it does not bring relief, as the market is stabilizing within a seller's market territory. As a result, prices are anticipated to continue their upward trajectory in the near future.

In May alone, the price growth was extraordinary. Seasonally adjusted Home Price Index (HPI) increased by 3.2%, median price by 3.5%, average price by 3.7%, fixed-wight adjusted average by 4.0% and Benchmark price by 1.6%.

This is a bubble-like appreciation and a confirmation to insights about FOMO (Fear of Missing Out) shared by real estate industry experts last month. Here is the ratio of Sale Price / List price showing how aggressively buyers are bidding for the properties. The latest value is starting to resemble 2016-2017 and 2021-2022 periods.

One of the key differences between the present time and those previous periods is the housing affordability landscape. Currently, the price appreciation starts from a very unaffordable level, and if housing affordability is calculated using the minimum of fixed and variable mortgage rates - the Toronto Metro real estate market becomes the most unaffordable since at least the 1980s.

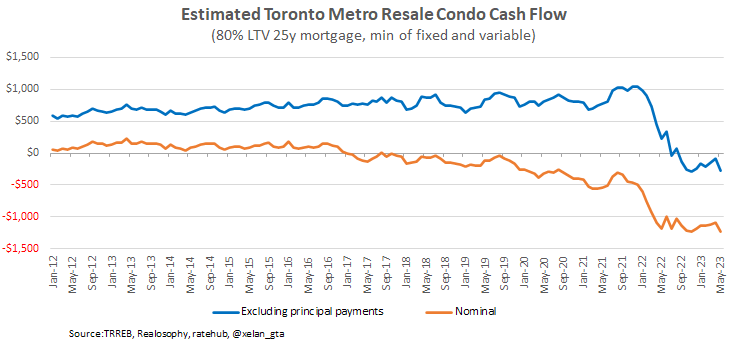

Along with the housing affordability, cash flow component of investment attractiveness deteriorated back to the record-lows.

The issue of negative cash flow is now spreading from resale to the new construction segment. Urbanation & CIBC have released a study on this topic (link), which builds upon their previous research conducted in 2018 (link). If you are new to this subject, these studies offer valuable insights into the matter.

New construction sales are recovering from previously very low levels.

Although housing completions initially began on a strong note, they experienced a significant decline in April.

Population Growth

I keep closely following the data related to Canada’s population growth because we are literally witnessing a “tsunami” unfolding right before our eyes and the data keeps getting worse.

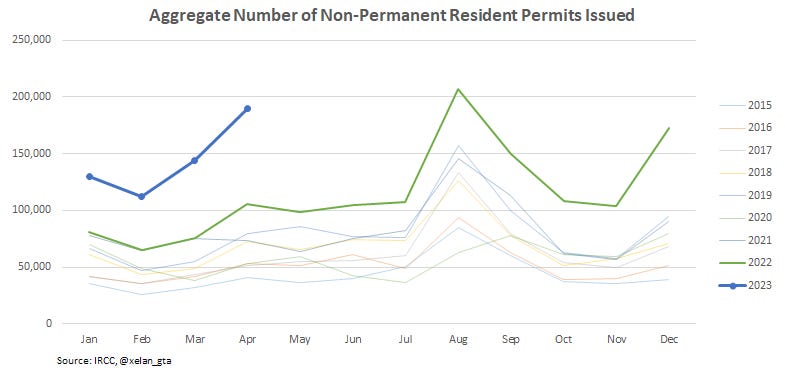

In April, the number of non-permanent resident permits issued surpassed previous levels by a staggering threefold.

New study permits were an important contributing factor to that.

Additionally, the number of Post-Graduate Permits issued in April reached nearly eight times the historical average.

This spike can be attributed to a government program that allows former international students who were unable to accumulate sufficient work experience for Permanent Residence to extend their work permits (link). Without that program, those temporary residents would have left Canada so it is definitely a contributing factor to population growth.

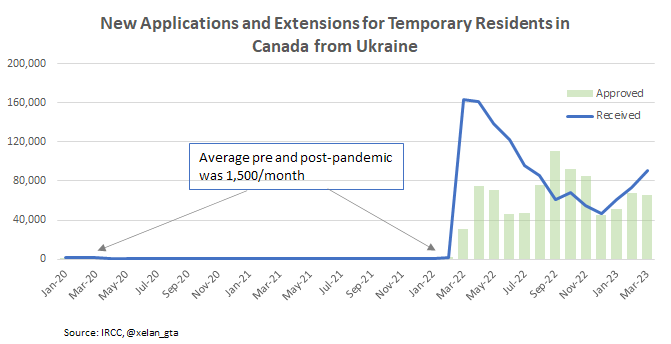

Moreover, there has been an unprecedented influx of temporary residence applications from Ukrainians, with a staggering 835,097 applications approved within the last 12 months.

It is important to note that not all new non-permanent resident permits directly impact population growth, as some are simply renewals or transitions between different pools.

This combination of factors creates the perfect storm for population growth in Canada. In one of my recent newsletters titled "Population growth - is Canada biting off more than it can chew?" (link), I elaborated on the challenges and risks associated with this situation.

To provide a concise summary, here's a quick analogy:

Imagine a bus stop where 1000 people arrive, but the bus can only accommodate 500 passengers. By the time the next bus is scheduled, another 1000 people arrive, and so on. This analogy represents Canada's current situation of population growth, where the capacity of the bus symbolizes immigration quotas. It remains unclear how the Government of Canada intends to address this issue.

I am very pleased to see that more attention is drawn to the crucial topic of explosive population growth in recent years, primarily driven by an unrestricted surge in international student enrollments. However, I disagree with the mainstream assessment that Designated Learning Institutions (universities, colleges, etc.) bear sole responsibility due to their rapid expansion and predatory recruitment practices.

In reality, incentives for international students originate directly from our government(link) in the form of various programs helping to obtain Permanent Resident status(link), extensions of temporary status(link), a framework for attractive costs(link), maximum work hours(link), scholarships(link), social programs(link), ability to bring the family(link), and more.

There is clear evidence that these incentives are effective, as demonstrated by survey data from IDP ranking Canada as a top destination for international students.

And here is another ranking by Keystone Education Group

The policy framework is so successful that in 2022 the total number of international students in Canada surpassed that of the United States, a country with an 8 times larger population.

I also shared a report on Twitter indicating that Canada had the highest number of international student enrollments globally in 2022 (link). However, I have not been unable to verify the accuracy of this data, and the author has not responded to my inquiry.

While it may sound reasonable to put all blame on Designated Learning Institutions I hope to have presented a compelling argument that the government is also part of the problem here. Furthermore, I’d like to emphasize that the government contributes to the problem specifically due to favourable policies that position Canada as a top destination for international students. While there are suggestions regarding the implementation of quotas for international students, they make very little sense as long as the existing incentives remain intact.

Conclusions

Toronto Metro real estate market continues to experience tightness, and activity is still low with Sales, New Listings and Active Listings all below historical averages.

The combination of market tightness and seasonality is driving prices up, which are growing at a very rapid pace, particularly in the 905 single-family segment. The rate of growth resembles that of a bubble-like appreciation, but the market balance indicators are insufficiently tight to justify it.

The most likely explanation for this phenomenon is that prices are still below peak values, which buyers perceive as a "discount" and are thus more inclined to bid higher prices. However, it is important to note that the current market is also the most unaffordable it has been since the 1980s, presenting a significant challenge for further appreciation potential. While there are similarities to previous periods of rapid price appreciation in 2016-2017 and 2021-2022, the current situation has distinct factors at play. It will be interesting to observe how far the current bull market stretch will progress, but there are clearly strong headwinds ahead.

A key development in May was a significant increase in new listings, which prevented further tightening of the market. It remains uncertain whether this was a short-term spike or a potential trend change, making it important to closely monitor this statistic. It could potentially be a turning point in the market dynamics.

There have been no major changes observed in the rental market, but the new construction segment experienced a notable spike in sales and a decline in newly completed units.

Population growth continues to be a key narrative in 2023. The number of new non-permanent resident permits, which serves as a leading indicator for international inputs into population growth, further increased in April, driven by a surge in study permits issued to international students and Post-Graduate Work Permits. The rise in international student enrollments can be attributed to various factors, including a global increase in demand for international education, government policies that position Canada as a highly desirable destination for international students, and recruitment efforts by Canadian Designated Learning Institutions. Canada became the top destination for international students globally.

Furthermore, a significant number of Ukrainians are arriving in Canada on a temporary basis through various channels. Over the past year, more than 800,000 new applications and extensions from Ukrainians were approved and new applications continue to arrive in high numbers. While the spotlight seems to be on international students, I’d like to highlight that Ukrainians arriving in Canada are a significant driving force behind the increase in non-permanent residents. So far it is the biggest one in 2023.

All these factors contribute to a “perfect storm” for population growth in Canada, leading to expectations of new records ahead.